Integrated Financial Planning

and Investment Management

Together Planning serves individuals and families looking for a partner in financial planning and investing. We form strong, long-term relationships with our clients, which allows us to provide high quality advice in all areas of your financial life. As our client, you will have unlimited access to your advisor and regularly scheduled reviews to ensure your investments are in balance and your financial goals are on track.

Financial Planning Topics

Cash Flow & Retirement Counsel

We run multiple scenarios as needed and provide advice to equip you to efficiently reach your goals.

- Retirement timing and probability of success

- Tax-efficient withdrawal strategies

- Social Security claiming strategies and pension election

- Tax planning strategies to reduce income taxes where possible

- Education funding analysis

- Home purchase decisions

- Employee benefits review

- Charitable giving strategies

Investment Analysis & Ongoing Portfolio Management

We analyze your current investments and whether they are appropriate given your goals, risk tolerance, and time horizon.

- Review of existing investments and their costs

- Development of risk tolerance profiles and appropriate asset allocation

- Ongoing management of your investment portfolio

Insurance Sufficiency

Evaluation of types and amounts of insurance needed based on your goals.

- Assessment of insurance needs

- Review of existing coverage

- Insurance recommendations

Estate Planning Design

Assist you, executors, or trustees in estate plan decisions.

- Identify estate planning goals

- Review of current estate design

- Determine if alternate design is more efficient based on your goals

Implementation

Rebalancing and assistance with implementation of insurance strategies and estate planning decisions

- Account paperwork

- Tax-efficient withdrawal strategies

- Trades and money movement

- Working with your insurance agents to implement recommended policies

- Ongoing coordination with your tax professional and estate planning attorney

Financial Planning Process

Our process is designed to be flexible and customized to the needs of our individual clients. Below is an outline of our typical planning process, but we discuss what makes the most sense for your situation during our Get Acquainted meeting.

1. Initial Inquiry. Contact Us to learn more about our services and schedule a free Get Acquainted Meeting.

2. Get Acquainted Meeting. We will meet in-person or virtually to discuss your needs and objectives, whether our services are right for you, and provide you an estimate for the cost of our services. In preparation for this meeting, you will need to complete our Confidential Questionnaire and Risk Tolerance Questionnaire located on our Forms page.

3. Data Gathering and Initial Preparation. At the conclusion of our Get Acquainted Meeting you will be provided with a secure online form to help gather your financial documents. After we receive your documents, we will ask clarifying questions and schedule your Plan Presentation Meeting.

4. Goal Setting Meeting. In this meeting, we will discuss your expectations for the future, any financial questions or concerns weighing on your mind, and any goals you have. We will also discuss the Risk Tolerance Questionnaire.

5. Analysis and Plan Formulation. We will analyze the information you provided and review various options and opportunities to achieve each planning objective. We will then create our final report including our observations, assumptions, and specific recommendations with an action plan.

6. Presentation of your Financial Plan. At your Plan Presentation Meeting, we will review your financial plan and our recommendations. Together Planning will assist in implementing your plan.

7. Implementation. During implementation, we will open and transfer accounts using electronic forms. We will also help you access your client portal and complete any recommended action items, including coordinating with other advisors, such as your tax professional, attorney and insurance broker.

8. Monitoring. We will meet regularly to review tax opportunities and financial tasks that need to be completed. In the meantime you will update us on changes in your situation and goals. We will also meet and review your investments and update you on overall market trends and your portfolio’s performance.

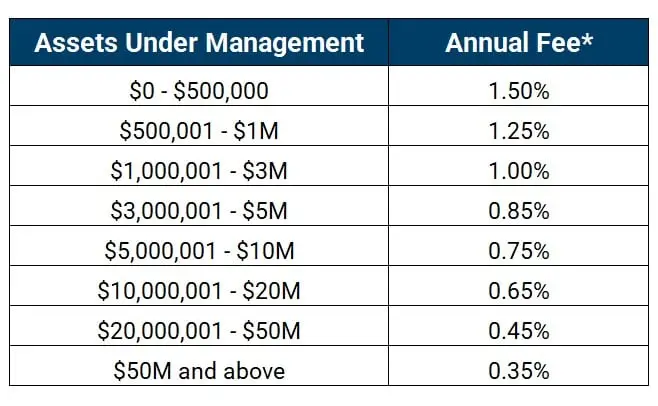

Fees

At Together Planning, we value transparency. Our Financial Planning and Investment Management fees are listed below. As fee-only financial planners, we do not receive any commissions whatsoever and are only compensated directly by our clients.

*The fee is stated as an annual percentage, billed quarterly in arrears.