You woke up today to headlines that market futures fell overnight, and we are seeing another big drop so far today. You may be wondering if things have changed since our last message to you, and if you should do something different.

Overnight, markets reacted to fears that many parts of the world, including the United States, are not prepared for the Coronavirus. Many health experts are recommending that people stay home as much as possible until the situation becomes better.

The good news is that there is historical evidence that measures can be taken to lessen the number of people infected by the virus. The world is rapidly reacting today to this, and countries that have not had this happen before are learning fast. The plan now is to minimize the number of infected people. In the recent past, Viruses like this one have naturally become less problematic once people take measures to contain it.

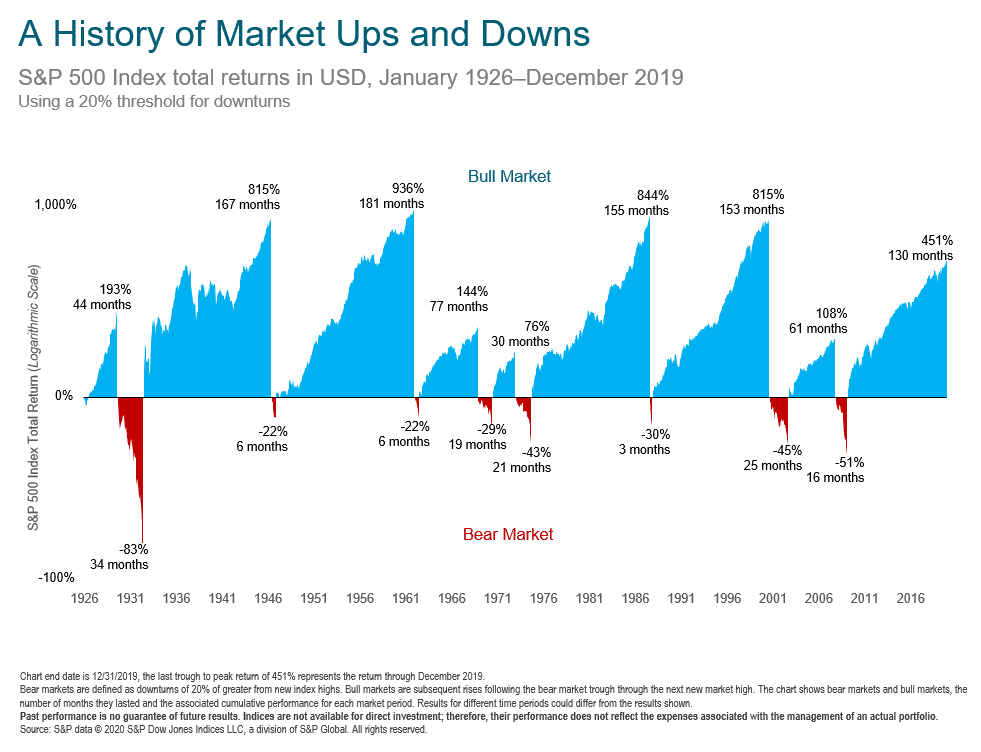

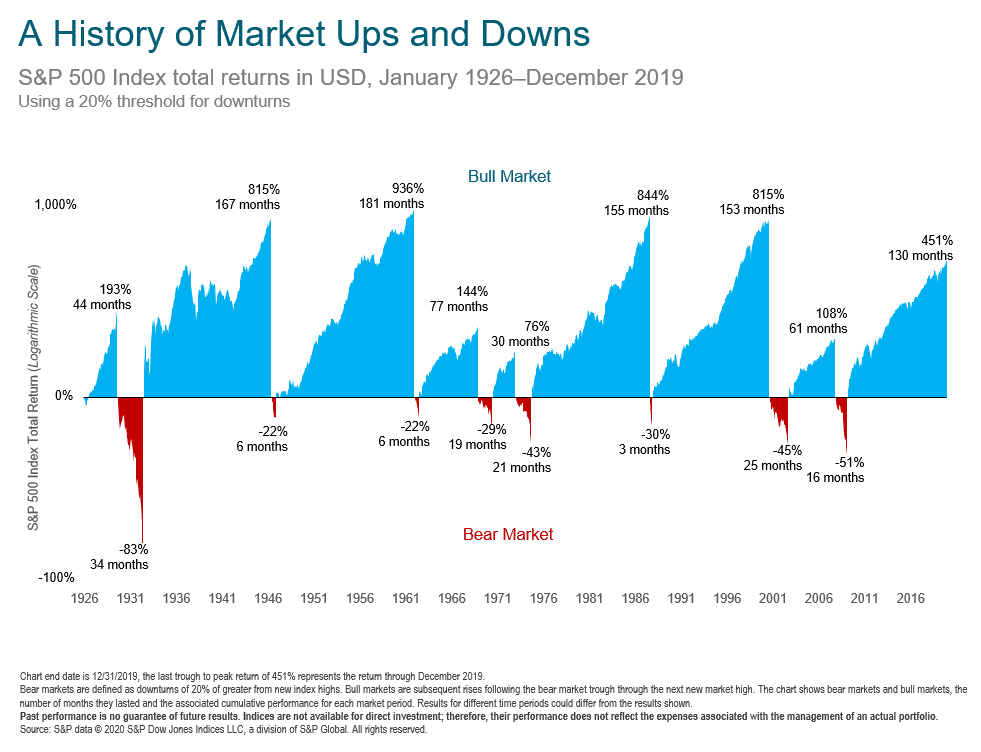

Meanwhile, we wanted to send a few quick visuals to reassure you that the markets have seen worse shocks than this, and have bounced back, rewarding long-term investors. While this event is certainly unique in many ways, market shocks and recessions are completely normal.

The past few weeks have been uncomfortable. No one wants to see their portfolio value decline. We want to help you keep it in perspective so that you can make the best decision you can. We are monitoring this situation for its severity and will be in touch with you if your situation merits any changes. By and large, we see this as a significant, and potentially long-lasting market event, but similar to others we’ve seen in the past.

We are now back to where we were at the beginning of 2019 in the value of the S&P 500 index. The climb took over a year and the drop took less than a month. We will see more declines before it is all over, but as of right now we have given up about 15 months of gains in U.S. Large Cap stocks.

We are now back to where we were at the beginning of 2019 in the value of the S&P 500 index. The climb took over a year and the drop took less than a month. We will see more declines before it is all over, but as of right now we have given up about 15 months of gains in U.S. Large Cap stocks.

The prices of these holdings are driven up when rates are dropping, which we have experienced the past few years. Now we are seeing the prices of preferred stocks be driven down by overall market momentum and fear. The difference between the 52-week high and the 52-week low is 20%. It is significant, but not as large as with common equities.

What should you do now?

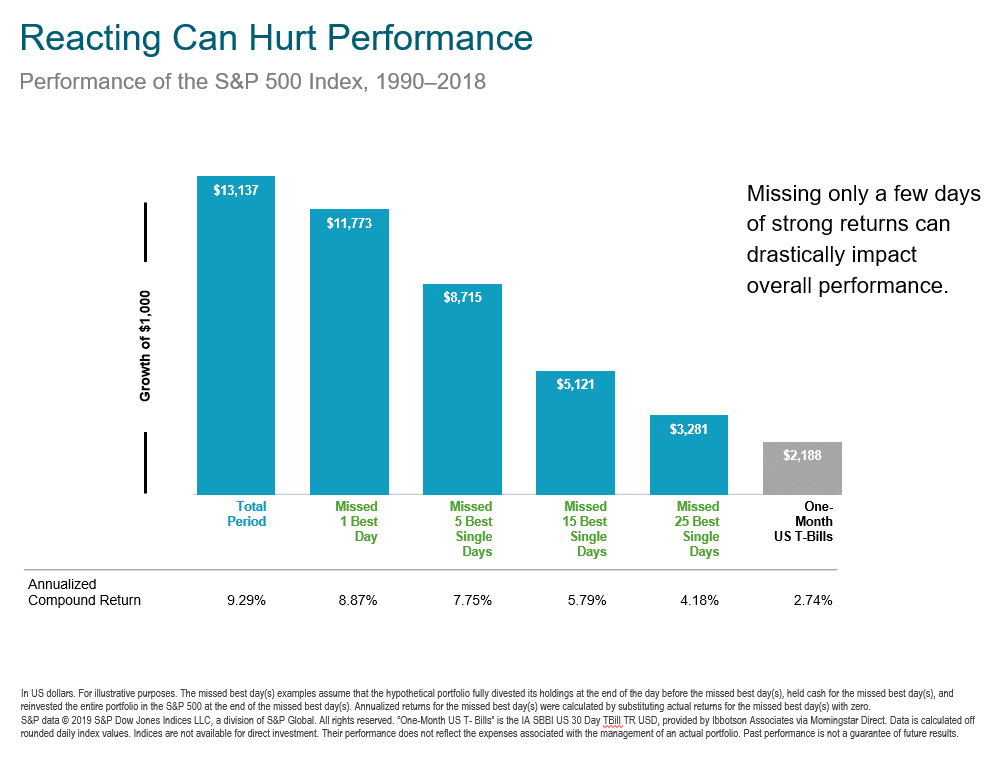

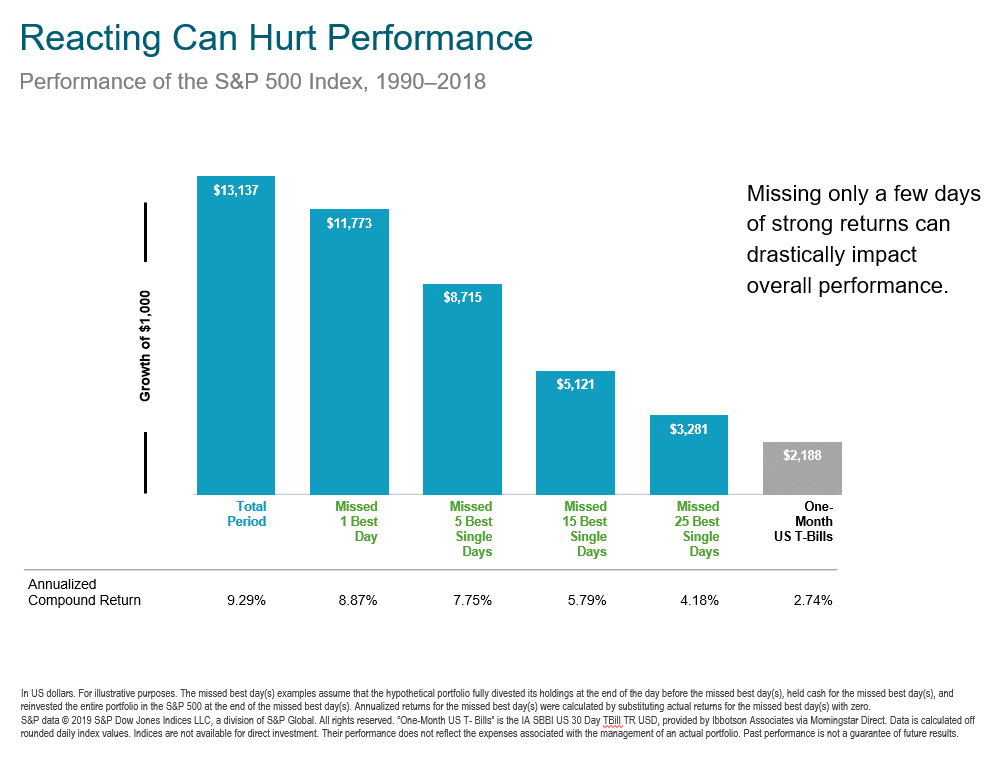

The temptation to exit the market and avoid any more drops in value can be very strong when you see this decline. We understand that. The problem is that, just like no one could have predicted the timing of this decline, we also can’t predict the timing of the recovery. Leaving the market and getting back in later requires making two lucky decisions—when to leave and when to get back in. The chart below shows what you give up if you miss even one good day on the recovery side.

The prices of these holdings are driven up when rates are dropping, which we have experienced the past few years. Now we are seeing the prices of preferred stocks be driven down by overall market momentum and fear. The difference between the 52-week high and the 52-week low is 20%. It is significant, but not as large as with common equities.

What should you do now?

The temptation to exit the market and avoid any more drops in value can be very strong when you see this decline. We understand that. The problem is that, just like no one could have predicted the timing of this decline, we also can’t predict the timing of the recovery. Leaving the market and getting back in later requires making two lucky decisions—when to leave and when to get back in. The chart below shows what you give up if you miss even one good day on the recovery side.

The bright side

The good news is that, if your portfolio is matched to your time horizon and your objectives, you are all set to weather the turbulence. There have been more good days than bad days in market history, and the good days have added up to significant long-term growth for investors. If history tells us anything, those good days will come again. Check out this graph for some perspective on how much more the good has outweighed the bad. Even the bad memories of 2000 and 2008 look like blips compared to the growth experienced by those who stayed invested throughout those periods.

The bright side

The good news is that, if your portfolio is matched to your time horizon and your objectives, you are all set to weather the turbulence. There have been more good days than bad days in market history, and the good days have added up to significant long-term growth for investors. If history tells us anything, those good days will come again. Check out this graph for some perspective on how much more the good has outweighed the bad. Even the bad memories of 2000 and 2008 look like blips compared to the growth experienced by those who stayed invested throughout those periods.

How Bad is it?

The S&P 500 We are now back to where we were at the beginning of 2019 in the value of the S&P 500 index. The climb took over a year and the drop took less than a month. We will see more declines before it is all over, but as of right now we have given up about 15 months of gains in U.S. Large Cap stocks.

We are now back to where we were at the beginning of 2019 in the value of the S&P 500 index. The climb took over a year and the drop took less than a month. We will see more declines before it is all over, but as of right now we have given up about 15 months of gains in U.S. Large Cap stocks.

What about income holdings?

Even fixed income holdings like preferred stocks, exchange-traded debts and REITs are at lower prices now. Energy partnerships have seen their unit prices fall sharply with the drop in oil prices. It is not fun to see the market value decline like this in an income portfolio. Keep in mind that the market value does not impact the expected income. For the energy partnerships, the dividend yield (annual divided payment divided by market value) has shot up to 25% or more for some. This is not a time to sell these holdings. It might be a time to buy more. Most of the energy partnerships in our portfolios do not have commodity exposure and their businesses are not truly impacted by oil prices, they just get hammered along with the rest of the sector. Preferred Stocks The prices of these holdings are driven up when rates are dropping, which we have experienced the past few years. Now we are seeing the prices of preferred stocks be driven down by overall market momentum and fear. The difference between the 52-week high and the 52-week low is 20%. It is significant, but not as large as with common equities.

What should you do now?

The temptation to exit the market and avoid any more drops in value can be very strong when you see this decline. We understand that. The problem is that, just like no one could have predicted the timing of this decline, we also can’t predict the timing of the recovery. Leaving the market and getting back in later requires making two lucky decisions—when to leave and when to get back in. The chart below shows what you give up if you miss even one good day on the recovery side.

The prices of these holdings are driven up when rates are dropping, which we have experienced the past few years. Now we are seeing the prices of preferred stocks be driven down by overall market momentum and fear. The difference between the 52-week high and the 52-week low is 20%. It is significant, but not as large as with common equities.

What should you do now?

The temptation to exit the market and avoid any more drops in value can be very strong when you see this decline. We understand that. The problem is that, just like no one could have predicted the timing of this decline, we also can’t predict the timing of the recovery. Leaving the market and getting back in later requires making two lucky decisions—when to leave and when to get back in. The chart below shows what you give up if you miss even one good day on the recovery side.

The bright side

The good news is that, if your portfolio is matched to your time horizon and your objectives, you are all set to weather the turbulence. There have been more good days than bad days in market history, and the good days have added up to significant long-term growth for investors. If history tells us anything, those good days will come again. Check out this graph for some perspective on how much more the good has outweighed the bad. Even the bad memories of 2000 and 2008 look like blips compared to the growth experienced by those who stayed invested throughout those periods.

The bright side

The good news is that, if your portfolio is matched to your time horizon and your objectives, you are all set to weather the turbulence. There have been more good days than bad days in market history, and the good days have added up to significant long-term growth for investors. If history tells us anything, those good days will come again. Check out this graph for some perspective on how much more the good has outweighed the bad. Even the bad memories of 2000 and 2008 look like blips compared to the growth experienced by those who stayed invested throughout those periods.