Last week, two employment reports were released that showed a decline in new hires and an increase in new jobless claims. Markets immediately began a sell-off driven by concerns that these reports indicated a slowing economy and an increased likelihood of recession. The sell-off was also fueled by an increase in interest rates in Japan, which is unrelated to the US economy, but increased the cost of investing for some funds who were borrowing at low Japanese rates.

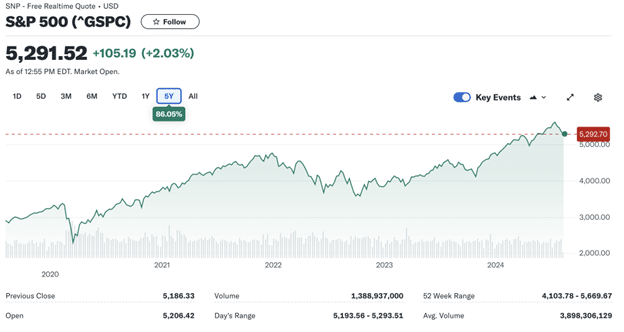

From the market close of July 31st through the close of August 5th the DJIA lost 5.24%, S&P 500 lost 6.08% and NASDAQ lost 7.9%. Even after these losses, all three indexes are still positive year to date, (DJIA +2.62, S&P +9.3% and NASDAQ +9.7%).

So, the question is, “Is the market decline an indication of a coming recession? Or is this just normal volatility, and we are still moving in a good direction?”

It can be helpful to get a visual perspective of market values over the past five years, so we clipped this image from Yahoo finance. Some news anchors and Internet finance stars want you to feel afraid so that you will pay attention to their content, but in reality we have only returned to late spring / early summer values. The past few days have demonstrated market volatility that is historically normal. This is the risk in the market that leads to positive returns over time. If there were no downward movements, there would be less reward for investing.

Are we beginning a recession? Since the generally accepted definition of a recession is two consecutive quarters of negative growth of GDP, we won’t know the answer until January 2025 when fourth quarter GDP numbers are released.

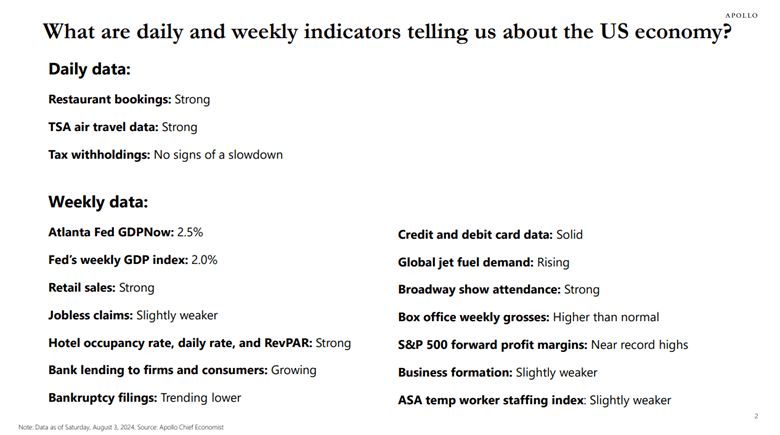

Despite the loss of market value over the past few days, many indicators in the economy are strong. For a snapshot view of several economic activities see this summary chart of daily and weekly indicators of the US Economy from Apollo Global Management:

It is important to remember that the Fed’s dual mandate includes stable prices and full employment. It does not include economic growth or recession avoidance. Thus far the recent fight has been against inflation, as the labor market has been tight, resulting in low unemployment and growing wages. So, should the cooling of the labor market trigger a shift by the Fed toward their full employment mandate?

What is full employment? Current thought puts “full employment” at the unemployment rate at which inflation does not continuously increase. One could argue that there is room for an increase in unemployment to reduce inflationary pressures. This theory is centered around the Non-Inflationary Rate of Unemployment, NAIRU, that views full employment not as an absolute number, but rather related to the inflationary pressures it can create.

I found Chairman Powell’s comments last week very encouraging. “We have stated that we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent. The second-quarter’s inflation readings have added to our confidence, and more good data would further strengthen our confidence.” In response to a question at his news conference he stated this data is “exactly what we want to be seeing.” I have not always been confident in the decisions the Fed has made since the beginning of the Covid-19 global pandemic.

When it hit in early 2020, essentially shutting down global economies including the US, the US government responded by releasing (eventually) over $6 trillion in fiscal stimulus to save the economy from collapse. Global economic shutdowns resulted in supply chain-driven shortages of goods. Consumers reduced spending because stores were closed and because there were fewer items to buy. Savings (bolstered by stimulus checks) grew.

Then, as we got into 2021, businesses began to figure out how to serve their customers in a “semi-closed” environment and consumers had more money to spend than there were goods to purchase.

The classic economic period of “dollars chasing goods” produced inflation.

The Federal Reserve and the US Treasury told us that inflation would be “transitory” and would fall as supply chain issues were resolved. “Don’t worry!”

At that time, I thought , “No way Jose! You can’t put $6 trillion of stimulus into the US economy over about an 18-month period, while incurring supply shortages, without creating significant inflationary pressures. History tells us that this can only be reversed by cooling the economy down through high interest rates typically, resulting in a recession.” I also thought that the Fed was too slow in acting to cool the economy, therefore increasing the risk of a period of economic unpleasantry.

So, who was right?

- Personal Consumption Expenditures, a key inflation indicator, declined from 3.7% in the first quarter to 2.6% in the second quarter.

- Second quarter GDP rebounded from an anemic 1.4% in the first quarter to 2.8% and GDP growth for the first half of 2024 is a healthy 2.1%. This increase was driven by consumer spending and inventory buildup.

- Consumer spending, (70% of GDP), has slowed from the levels of 2023 but remains strong. Private Domestic Final Purchases for the first half of 2024 grew 2.6% over 2023. So, while consumer spending is at a healthy level, it is not a real threat to the fight to reduce inflation.

- Wage growth has slowed from $396.8 Billion in the first quarter to $237.6 Billion in the second and the unemployment rate increased to 4.1%. Labor market supply and demand are coming closer to equilibrium reducing wage/price inflationary spiral risks.I believe all of this supports the conclusion that the really smart people, Powell and Yellen, were right.

I believe all of this supports the conclusion that the really smart people, Powell and Yellen, were right.

Second quarter 2024 economic data released July 25th, shows that GDP bounced back from the unexpected drop in the first quarter, Personal Consumption Expenditures showed a decline toward the Fed’s target of 2% and the labor market seems to be cooling as exhibited by a bump up in the unemployment rate. It is looking more like the Fed may achieve the “soft landing” they have been hoping for. If they achieve this, and I hope they do, they will have proven this old curmudgeon wrong.

It is entirely possible that what we are seeing here is market volatility and we should not be changing our investment strategies based on market volatility. Those who have read some of my articles know that I have a great deal of respect for the commonsense approach to investing recommended by Warren Buffett. He has said “If the investor fears price volatility, erroneously viewing it as a measure of risk, he may ironically, end up doing some very risky things.”

None of us like to see our portfolios shrink. Unfortunately, they go both up and down. As I wrap up this article on Tuesday morning, we are seeing a nice rise in stock prices. Remember we are still positive year to date. Stay the course.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Together Planning has a reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Any economic forecasts set forth may not develop as predicted and are subject to change. Any references to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Market projections or investment growth, including those in examples, are not indicative of future results, should not be considered specific investment advice, do not take into consideration your specific situation, and do not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk, including changes in market conditions, and are not guaranteed. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein. FIRM NAME is a SEC registered investment advisor.