Social security is an important component of retirement planning for most retirees, even affluent ones. If you have earned income each year over a long career, your projected social security retirement benefits are likely to cover a meaningful portion of your fixed expenses in retirement (though unlikely to cover all of them).

Many Americans who are near retirement age have wondered recently whether turmoil at the Social Security Administration (and the federal government in general) makes it more attractive to claim their benefits earlier. Our answer is no. Changing benefit calculations would require more than an executive order. The only potential change to your strategy should be allowing more time for phone calls, appointments, and processing. With the closure of field offices and reduction in staff, it is wise to expect that any business with the social security administration may take longer.

Since social security benefits are in the news and on your mind, we thought it might be helpful to revisit some of the factors to be considered in developing a claiming strategy.

How to decide when to claim your benefits

Social Security rules are complicated, and it is important to consider many factors in deciding when to claim your benefit. All of these can affect the best strategy for you:

- Age

- Life Expectancy

- Plan to continue work

- Marital Status

- Survivor Needs

- Desired standard of living

- Need for income

- Total assets available

- Liquid assets

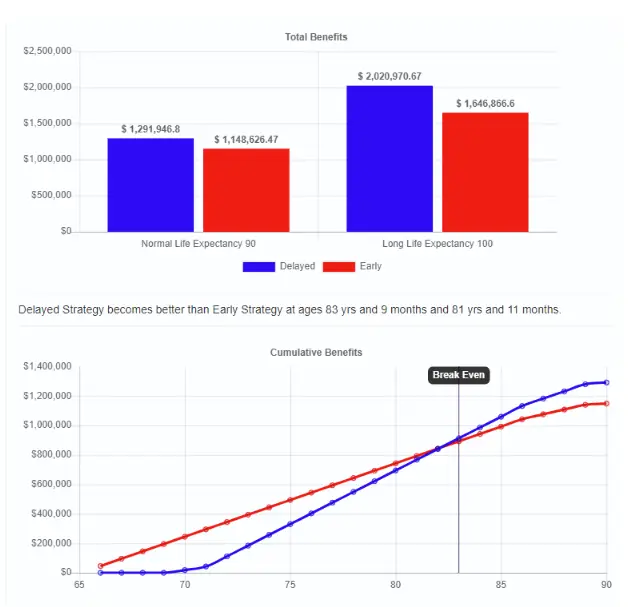

The longer you think you might live, the more you will benefit from delaying your claim. The breakeven age for delaying a claim to age 70 is generally in the early 80s (meaning if you expect to live to age 85, you will be better off delaying).

Some may plan to work longer than others. If you plan to continue working, it does not make sense to claim your benefit before your Full Retirement Age. Once you reach that magic age, your benefit would not be reduced by earned income.

If you have a spouse who will receive spousal benefits on your work record, it might make sense to delay your claim. Your surviving spouse would receive more benefits for their lifetime.

Some may need income early, while others have outside resources to use and may be more concerned about having the highest income possible later when your savings may be running low.

Regardless, when you begin benefits should be looked at holistically with your complete financial picture so that you can make the best choice for your situation.

Should you claim early?

You are able to claim social security retirement benefits as early as age 62, but the benefits are reduced. If you were born in 1960 or later, your Full Retirement Age is 67. If you claim at age 62, you will only receive 70% of your retirement benefit.

If you are unmarried, ready to stop working, and believe that you will not have a long life expectancy, it may be in your best interest to claim your benefit as early as possible. Health issues impacting longevity should be considered and might be a reason to claim even before Full Retirement Age.

Should you delay to age 70?

On the other hand, delaying your claim to age 70 will result in a permanent increase in your monthly benefits. Each month that you delay will increase your benefit by ¾%, so a three-year delay leads to a 24% increase in monthly benefits.

If you are likely to live well into your 80s, if you have other resources to cover your expenses while you wait, or if you are married to someone with a smaller expected social security benefit, it is likely in your best interest to delay your claim as long as possible.

Your decision could have a large financial impact

A Social Security claiming strategy considers all your individual needs and characteristics, as well as the complicated laws and rules to develop a plan that will result in the highest expected benefit for you.

The graphic below is a sample from a report comparing two potential strategies for a married couple. It shows that by delaying their claim to age 70 instead of claiming early at age 62, this sample couple could receive significantly more in lifetime benefits. As long as they live to age 83 (more and more likely these days), they will receive a higher lifetime benefit in the “delay” scenario.

This can be a complicated decision, and the optimal strategy may involve a mix—perhaps one spouse claims early and the other delays. Perhaps both should claim early or both should delay. We can help you make the best decision. It could result in a great deal more benefit for you!

Additional resources:

Here is a free online tool you can use to test some strategies on your own: https://opensocialsecurity.com

Here is a relevant article in Forbes: Should You Claim Social Security Early Because Of DOGE Cuts To SSA?

The AARP website has a section devoted to social security information: https://www.aarp.org/social-security/

Together Planning is a registered investment advisor. The information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Together Planning has a reasonable belief that this marketing does not include any false or material misleading information statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.