We hope you enjoy this fun article written by our Financial Planning Assistant, Jack Bertelson. Jack is doing a great job for us and is learning a lot about financial planning and investments. He wrote this article to share with you some entertaining information about prediction markets, a relatively new trend. Full disclaimer, though: we think these markets are entertaining to read about. This article is not an endorsement and we don’t mean to imply that it is important to keep up with these markets or that they should have any impact on your financial decisions.

Feeling Lucky? What We Can Learn From Prediction Markets

People are making hundreds of thousands, even millions, of dollars by betting on the weather, sports, politics, and more. With platforms like Kalshi and Polymarket, users can make predictions on a wide variety of events like snow or elections and make money when they predict correctly. Today, users can place bets on how many times Elon Musk will Tweet this month, when Taylor Swift will become pregnant, or how many tornadoes will hit the U.S. in January.

Political bets draw a lot of attention on these platforms. Last November, Kalshi saw over $100 million traded in the form of bets on the New York City mayoral race. Shockingly, this was only the fourth largest cash pool for an event on Kalshi last year. In fact, over $500 million was traded on the 2024 presidential election, which still holds the record for the most traded-on event, by total amount of cash, in the brief history of the betting platform. You can see the total pool for various bets on kalshi.com and polymarket.com. Gambling is heavily restricted by laws in the U.S, so how do prediction markets like Kalshi and Polymarket operate without legal trouble?

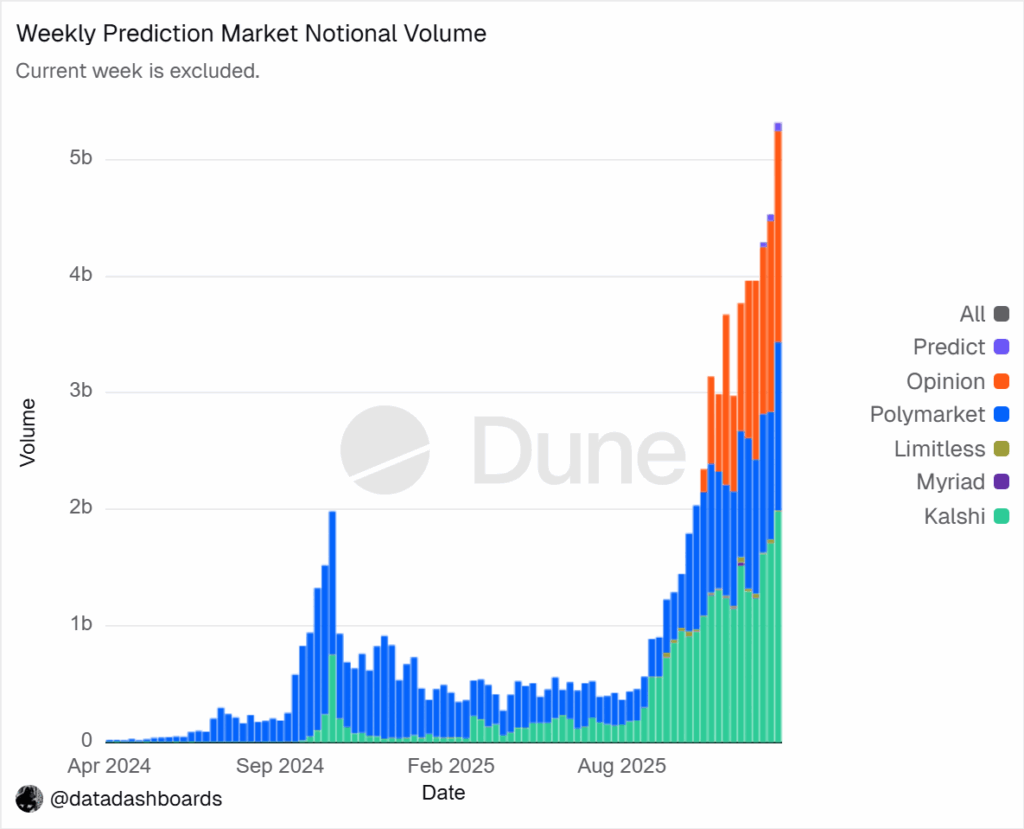

Source: Dune Analytics https://dune.com/datadashboards/prediction-markets

How are they different from traditional sportsbooks?

At first glance, Kalshi just seems like any other betting platform. A user bets money on what they think the outcome of a certain event will be, just like on a sports betting app like PrizePicks or other online sportsbooks. There is a difference, though. On traditional betting platforms, the user is playing against “the house”—the sportsbook itself— who sets the odds for the event. On prediction markets like Kalshi, the user is buying or selling “event contracts” which turn the outcome of an event into a yes or no question. Essentially, the user is buying or selling a Yes or No share. Based on how much money people are willing to spend on a share, the contracts are priced between $0.01 and $1.00. In short, prediction markets have their odds set by the users’ trading activity while traditional sportsbooks set their own odds.

Yes and No shares

The individual price of a Yes or No share is set by the general confidence of the buyers. If the buyers are generally confident that the answer will be yes, the price for a Yes will be higher while the price for a No will be lower. The price of both shares will always add up to a dollar so the price of each share, in cents, corresponds to the percentage chance for each outcome as decided by the buyers. For example, if the price of a yes share is 75 cents, there is a perceived 75% chance that the event will occur, the price of a no share must also be 25 cents in this case. The event contract system is crucial to how prediction markets avoid the legal restrictions on gambling.

Prediction Markets vs the Stock Market

Prediction markets and the stock market certainly share some characteristics, like how the units are priced by the market of buyers and sellers. Another similarity is that both stocks and event contracts can be sold for a gain or loss after being bought by a trader. However, Kalshi’s event contracts are capped at a dollar. Stocks can grow indefinitely and corporate leaders can drive increases in value by developing new products, entering new markets, reducing costs, etc. Events either occur or they don’t. Stocks are also long term, sometimes being passed down through generations. Event contracts will expire after the event ends, which is usually not very long after the shares were bought.

How is it legal?

The Commodity Futures Trading Commission, or CFTC, allows the trading of event contracts using registered exchanges, meaning that the sale of each share is officially legally registered. This allows prediction betting markets to facilitate the trade of event contracts. Several states have made moves against Kalshi; Arizona, Illinois, Maryland, Montana, Nevada, New Jersey, New York, and Ohio have all sent cease and desist letters to Kalshi and other prediction markets. The letters usually make the argument that the prediction markets need a license to operate sports predictions specifically. Nevada was successful in its legal battle with Kalshi over sports predictions.

What can you bet on with prediction markets?

Prediction markets are not limited to just elections, sports and weather. Kalshi has categories for Tech & Science, Companies, Economics, Pop Culture, or even Transportation. These unique categories helped Kalshi and other prediction markets to gain public attention and grow into what they are today by separating them from other betting platforms that are usually focused on sports or another single category. In prediction markets, people can bet on virtually anything from how many Rotten Tomatoes the movie “28 Years Later: the Bone Temple” will earn to whether California will suffer a magnitude 8 earthquake before 2027 to whether Christ will return this year.

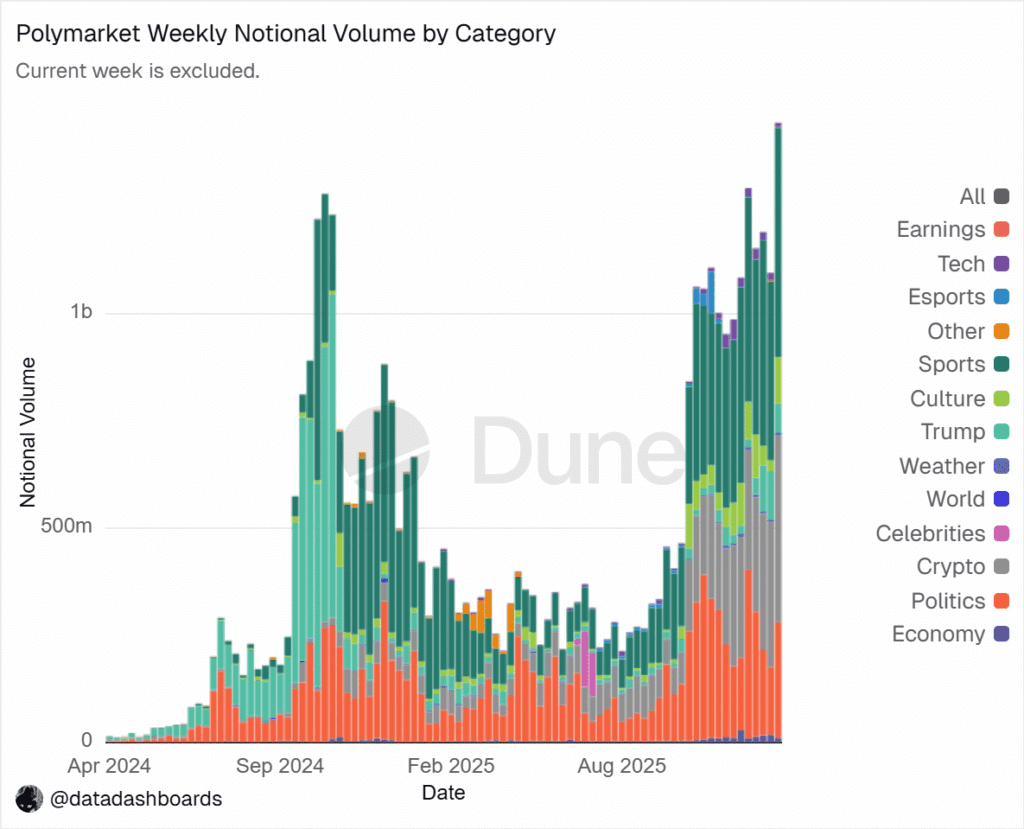

Source: Dune Analytics https://dune.com/datadashboards/prediction-markets

Why does this matter?

We always see what the experts are thinking about the economy and markets. Every quarter we report to you about the forecasts of economists for interest rate changes, GDP growth etc. These platforms allow us to see what average people think will happen. Knowing this can provide helpful color to financial decisions. We certainly do not encourage anyone to gamble on the weather or anything else. Even for people who don’t want to bet, prediction market platforms can provide helpful insight to how the people around you see the world.

Resources

Gouker, Dustin. “Where Things Stand for Prediction Markets Legally in November 2025.” Event Horizon, 24 Nov. 2025, nexteventhorizon.substack.com/p/where-things-stand-for-prediction-markets-legally.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Together Planning has a reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Any economic forecasts set forth may not develop as predicted and are subject to change. Any references to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Market projections or investment growth, including those in examples, are not indicative of future results, should not be considered specific investment advice, do not take into consideration your specific situation, and do not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk, including changes in market conditions, and are not guaranteed. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein. Together Planning is a SEC registered investment advisor.