Plenty of clients and friends have asked me recently whether they should buy gold. You may have seen that the price of an ounce of gold rose 60% in 2025, from roughly $2,600 per ounce at the beginning of 2025 to roughly $4,300 per ounce at the end of the year. As I am writing this today, it is trading at over $5,000 per ounce.

Where will the price go from here? I don’t know.

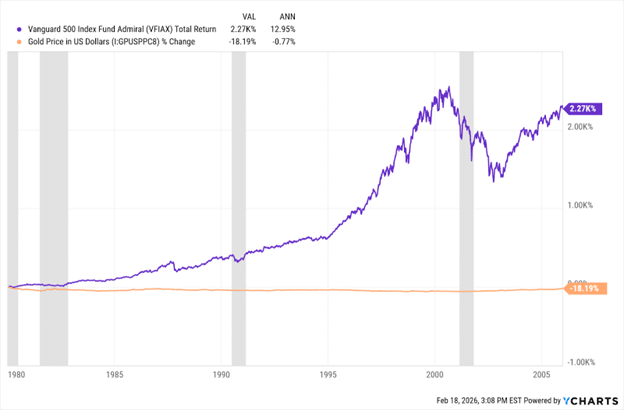

However, another time that the price of gold shot up was around 1980. On January 21, 1980, the price of gold hit $850 per ounce. From there, the price dropped and didn’t come back up again for over 25 years. If you bought an ounce of gold in 1980 for $850, 25 years later, in 2005, it would have been worth about $518. During that same 25-year span from 1980 to 2005, inflation averaged about 3.4%. So, to add to the heartache, that gold investment would have lost over 80% of its purchasing power during that time to inflation.

Had you instead invested your $850 in an S&P 500 mutual fund in 1980 (there weren’t many to choose from, but Vanguard had one) and reinvested all dividends, it would have been worth approximately $13,000 in 2005. This chart from Y Charts compares the price of gold to the S&P 500 index over that period. The shaded areas represent recessions. The S&P 500 index is in purple. The price of gold is in orange:

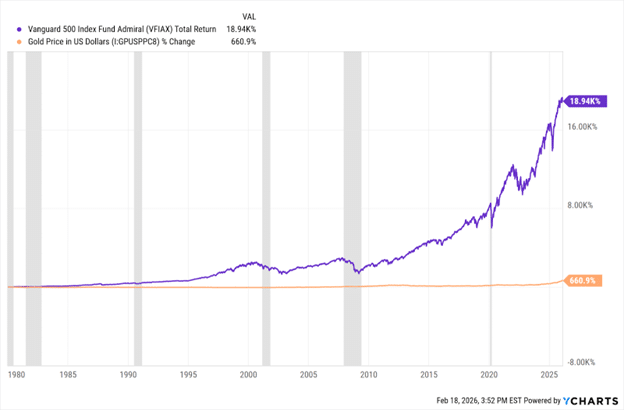

Here is the same chart from 1980 to the present. This is AFTER last year’s huge spike in the price of gold:

A decade ago (2006 – 2015), when I was a financial planner with Prudential Financial, I used a precious metal mutual fund in my portfolio models as a very small (1%-2%) part of the allocation. During that span, gold went up by 41%. For comparison, the S&P 500 rose by 72% during that time span. I learned that although precious metals provided some diversification, I did not love the performance.

Over the VERY long run, the price of gold mostly keeps pace with inflation. It rises and falls in long streaks, and is very unpredictable. Some of those streaks can last decades. However, unlike stocks, bonds, and other investments, it produces no revenue, dividends, or interest.

You could argue that most of the gold that has been mined throughout human history serves no actual purpose because it doesn’t actually do anything.

Or does it?

Over the last few weeks, I spoke with people I know who recently bought gold and asked them why they bought it. From these conversations I was reminded of why gold has always been a popular thing to own. In times of fear, having some gold brings comfort.

Imagine if most of what you saw on social media and in the news made you feel worried about the future of the world. Would having some of these gold pieces in your safe or safe deposit box make you feel better? Would owning a gold mutual fund or other precious metal investment strategy make you feel better about your overall portfolio? If you had fears about the U.S. dollar weakening, or inflation going higher, would having some gold or silver bring you some comfort in a “worst case scenario?” For many people, it does. If the U.S. dollar loses its purchasing power, or we have an end-of-the-world scenario, surely gold will still have value?

As a counter to that argument, many people believe that in a “worst case scenario”, ammunition may be more helpful than gold.

We all hope that scenario will never happen, but I can understand the feelings of security owning gold brings to some.

A nice thing about owning precious metals is that they can be used for non-financial purposes. You can wear them as jewelry or use them for decorative purposes.

You can own them in coins that have value in and of themselves, as collectibles. A very good friend and client of mine introduced me to coin collecting several years ago. Here’s a picture of some of our coins:

My friend loves coins because they are a part of history. When you hold a coin that is 150 years old in your hand, you wonder who else held that same coin? Where did they live? What were they buying with it? What was their life like at the time? Owning coins can give you a unique happiness as a hobby. It also has the double benefit of owning the actual precious metal that many collectible coins are made of.

I visited a reputable coin/precious metals dealer to ask him for more reasons why people buy gold. He showed me samples of gold coins and bars that he sells to his customers. He told me that if you were to leave the country, you could take the gold coins or bars with you and trade them for cash virtually anywhere in the world. The idea of this is attractive to many of his customers.

In my mind, owning gold, precious metals, and collectibles is like having a possession that gives you comfort and happiness, but also has a financial aspect to it.

However, I would not rely on the market value of precious metals going up to fund my retirement. Stocks and bonds have appreciated much more over the last century.

At times, like over the last year, precious metals can increase in value a lot and over a short period of time. Usually this is during times people are fearful. But if the future is like the past, it won’t continue. History has shown that gold largely just keeps up with inflation over long periods of time, with an enormous amount of volatility. It has more volatility than stocks, with much worse performance. It has been the worst of both worlds as a long-term investment.

Of course, I must acknowledge that we are never guaranteed to know the future. But in the case of gold, there is almost nothing in finance with a longer track record to go by.

I’ll end by sharing Dad’s favorite quote about gold, which he shared with our team as we recently discussed this topic at a team meeting. This quote is often attributed to Warren Buffett:

“Gold gets dug out of the ground in Africa… Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Please contact me for more information on this topic or to discuss further.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Together Planning has a reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Any economic forecasts set forth may not develop as predicted and are subject to change. Any references to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Market projections or investment growth, including those in examples, are not indicative of future results, should not be considered specific investment advice, do not take into consideration your specific situation, and do not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk, including changes in market conditions, and are not guaranteed. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein. Together Planning is a SEC registered investment advisor.