I imagine that everyone reading this has noticed a rapid increase in the cost of most everything we buy. Well, it is official now, the US economy is inflating. On June 16, Federal Reserve Board Chair Powell acknowledged that the rate of inflation is exceeding expectations after the May inflation rate was reported at 5% higher than May of last year.

The Fed has stated previously that the reopening of the economy could result in a spike in inflation, but they believed it would be “transitory” and the inflation outlook beyond that would be in an acceptable range. Even while short-term inflation expectations are rising more than expected, the Fed continues to expect longer run inflation to be around 2.0%.

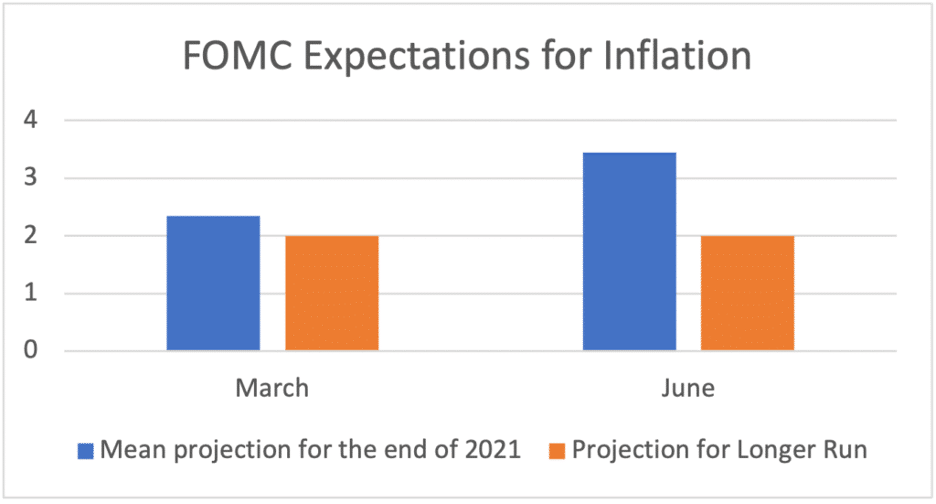

Once a quarter, the 18 voting members of the Federal Open Market Committee (FOMC) each give their forecast of where inflation will be at the end of the current year, end of the next two years and for the long run. At the March meeting all 18 members forecasted that PCE Inflation at the end of 2021 would be between 2.1% and 2.6%. At the June meeting, all 18 members forecasted that PCE Inflation at the end of 2021 would be between 2.9% and 4.0%. Every single member adjusted their projection of short-term inflation upwards. However, there was no change in the members’ expectations for rates for the long run. In March and in June, all 18 members projected longer run inflation to be 1.9%-2.0%.

In this article we will discuss inflation and its traditional causes, look specifically at the events that are causing prices to increase now and the potential impact of inflation on investors.

What is Inflation?

Inflation is a sustained increase in the price of goods and services in our economy. It reduces the purchasing power of a dollar thereby potentially impacting our quality of life. The US economy has experienced numerous periods of inflation during my lifetime the worst being from 1973 through 1982. In 26 of the 36 months from January 1979 through December 1982 inflation was 10% or higher with the peak at 14.8% in March of 1980. Paul Volker was chairman of the Federal Reserve Bank during this period and under his leadership the FOMC caused the prime interest rate (the lowest rate commercial banks charged their most credit worthy commercial customers) to increase from 11% to 21.5% with 18 separate increases in a 4 month period finally getting the hyperinflation under control.

What Causes Inflation?

Economists generally attribute inflation to one of three causes, demand-pull, cost-push or what is termed built in or embedded inflation.

Cause 1: Demand-Pull

Demand-pull occurs when the aggregate demand for goods services exceed supply. This can happen when the money supply increases at a rate in excess of the rate of increase in the production of goods and services. Demand exceeds supply resulting in increased prices. When I was studying economics in 1968 this was described as “abundant dollars chasing scarce goods”.

Cause 2: Cost-Push

Cost-push inflation occurs when the cost of producing goods and services increases and these costs are passed through to consumers. There may not be a significant supply/demand disequilibrium, but prices increase. This can be driven by sharp increases in commodity prices such as oil. This occurred in 1973 when the US was heavily dependent on foreign oil. OPEC led by Saudi Arabia embargoed the sale of oil to five nations, including the US, because they believed these countries aided Israel in the Yom Kippur war. Consumers experienced long lines at the gas pumps and watched the average price of a gallon of gasoline increase from $.36 to $1.19 between 1970 and 1980. Of course, oil is used in the manufacture of a significant portion of our economic output and so the sting felt throughout nearly everything.

Cause 3: Embedded Inflation

Embedded inflation is caused by past events. It is sometimes referred to as “hangover” inflation. Because prices have increased in the past, they are expected to increase in the future. Therefore, labor demands higher wages that are then passed through to consumers through higher prices creating a wage/price spiral.

There has been no embedded inflation in our economy for quite some time. Inflation has been low since the Great Recession. However, it was a major contributor to the hyperinflation of the late 70s and early 80s.

What is Causing Inflation Now?

Demand-Pull Inflation due to Government Stimulus and Pent-up Demand

When the Covid-19 pandemic hit the US, everyone stayed home to reduce transmission of the virus. All nonessential businesses such as theaters, restaurants, athletic events etc. were closed. As a result, the GDP for the second quarter of 2020 dropped an amazing 34%. Congress and the Fed took quick action to support the economy through both monetary and fiscal stimulus.

Stimulus checks, supplemental unemployment benefits and PPP loans pushed trillions of dollars into the economy. At the same time the Fed stepped up its quantitative easing (bond purchasing) program, pledged to keep interest essentially at zero and further pledged to do whatever it needed to do to hold the economy together. Inflation was not of concern, especially since it had been running below the Fed’s 2 % target for most of the last 9 years leading up to the pandemic.

Old guys like me have been through periods in which excess government stimulation resulted in inflation leading to higher interest rates causing a recession. You may recall that the government used monetary and fiscal stimulus during the Great Recession of 2010. This resulted in a lot of discussions in bank board meetings that this excess simulation would lead to inflation, higher rates and recession. But that did not happen as I said earlier, inflation has been below the Fed’s 2% target for most of the last 9 years.

Covid 19 vaccines became available earlier than most expected and vaccination rates increased rapidly beginning in February of this year. Thoughts were turned to reopening the economy and a surge in consumer spending driven by consumer’s pent-up demand with plenty of money to spend. Consumers used stimulus funds to reduce debt and increase savings since the economy was essentially locked down. The Fed has taken the position that reopening of the economy could result in a spike in inflation, but it would be transitory.

Cost-Push Inflation Due to Global Supply Chain Disruptions

The pandemic has caused disruptions in global supply chains resulting in a shortage of goods (the supply side) during a period of high demand. Creating “abundant dollars chasing scarce goods”, classical economics. The Fed has stuck to their transitory theory and that as consumers spend through their excess liquidity and supply chain disruptions are resolved the demand/supply disequilibrium will decline in the year following a full economic reopening.

Lumber prices are already abating, and both NVIDIA and AMD have reported that prices for their gaming chips are dropping from 2 to 3 times MSRP closer to MSRP. The Cost-Push factors that have partly driven inflation this year appear to be easing already.

How does inflation impact investment returns?

People invest to increase their purchasing power over time. Because inflation reduces purchasing power, it works counter to investor’s goals. Portfolio holdings that have a fixed coupon will deliver less purchasing power in the future because of inflation. Shortening the maturities of these types of holdings reduces this risk. Likewise holding securities that have fixed coupons for a period, and then are adjusted to an index, helps preserve purchasing power during inflationary periods.

Over the long run the best hedge against loss of purchasing power has been investing in equities. The average return for the S&P 500 since 1957 has been 8%. The average annual rate of inflation for that period is 3.5%. Historically, a rapid run up in inflation negatively impacts stock prices. Growth stocks are impacted more than value because their price assumes a growth in income which would be eroded by inflation.

For the long term investor, a decline in stock prices can provide buying opportunities. Trying to time peaks and valleys in the market seldom succeeds. The most successful long term investors stay invested. The pain of hyperinflation of the 70s and a 21.5% prime interest rate are forever burned into my memory. But I believe the factors causing current price spikes are not the same as those that drove inflation in the 70s and today’s factors can be resolved without the drastic actions that were necessary in the late 70s, early 80s.

Lastly, the information, tools and discipline available today are far superior to those of the 70s. The Ford administration’s plan for resolving inflation was for everyone to wear a big lapel button reading WIN that stood for “whip inflation now”. How silly!

In my 48 year business career, I have seen periods of economic health and deep recessions as well as extremely high and extremely low interest rates. What amazes me is the resiliency of the US economy and how quickly things can change.

As I said earlier, Paul Volker took the prime rate to 21.5% in December 1980, and single family residential mortgage rates were over 14%. This brought about the recession of 1981-1982, which created a huge inventory of unsold speculative homes. Banks were suddenly in the business of selling homes. Two years later, the demand for homes was so strong that the inventory was depleted, and builders could not build new homes fast enough.

Last week, after the FOMC met, the Dow Jones Industrial Average dropped 2.3% in two days. By the close of the market the following Monday, though, two-thirds of that market drop was recovered. In this same period, the yield on the 10-year treasury dropped from 1.57% to 1.45%, indicating that the bond market did not build in expectations of significant inflation and rate increases.

Based on my experience, I do not bet against the US economy.

Our belief is that, while some level of permanent inflation is inevitable, the spike that we are seeing today is transitory. The best way to preserve purchasing power for the long-run is to invest in equities and in fixed income securities with a low duration, reinvesting dividends into higher-yielding securities as rates rise. As always, the best investment strategy for you is the one that matches your risk tolerance, time horizon, and unique objectives. If those factors have changed for you, please discuss them with us.