We are honored to be celebrating our tenth anniversary of serving clients with Financial Planning and Investment Management. It has been a very rewarding journey as we work together as a team to help our clients work toward their goals. The new year gives us time to reflect on what we have done and where we are headed. Over the past year we have made some strides in developing our systems for how we serve you. We plan to build on that progress this year. We wanted to share a little bit about what you can expect from us this year.

We are available to you always

Our commitment to you is to be there for you when you need us. We love hearing from our clients, and we know that financial decisions don’t follow any set schedule or timeline. When you have something on your mind that we can help with, we want to hear from you! We love to be a part of your lives.

We are monitoring all areas of your plan

In addition to responding when you have a need, we are behind the scenes monitoring your investments and your plan whether you are calling us or not. Throughout the year, we are looking at your action items, your investment accounts, your estate planning concerns, your insurance needs, your tax situation, and all the other areas of your financial plan.

Early in the year: Focus on Tax Documents

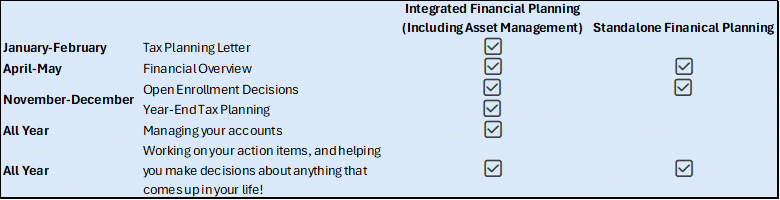

Within the next month or so, we will provide our investment management clients with a Tax Planning Letter listing all the documents you should expect to receive that will need to be reflected on your tax return for 2025. We look at retirement contributions and distributions, charitable gifts (from IRAs or to Donor Advised Funds), taxable gains and losses, partnership distributions, and other data to prepare a helpful guide for you. We can also share this directly with your tax professional if you would like.

Mid-year: Financial Overview

Later in the spring and summer, we will work to update Financial Overviews for our clients who use our financial planning service. This two-page document summarizes the highlights of every area of your financial plan. We will request some updated information from you, and we will send you an updated summary to look over. This is a good time for us to get together in person or in a virtual meeting to review your summary and check in on any updates you have, areas of focus for the coming year, and action items. We will reach out to schedule a meeting with you if you have time.

Later in the year: Open Enrollment and Year-end Tax Planning

In the fall we will review your plan and accounts again to look for any tax planning opportunities and retirement contribution opportunities and to confirm that any Required Distributions are sent on time. We will also remind you to share your open enrollment options with us so that we can help you take full advantage of employer benefits and make the best choice for insurance coverage. This is another good time for an in-person or virtual check-in and we will be inviting you to schedule a meeting at that time too.

We are available to you any time, and we are doing the planning whether you are coming in to meet with us or not. We know you are busy living your lives and we are here to serve you. Our goal is to help you worry less and enjoy more!

Together Planning is a registered investment advisor. The information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Together Planning has a reasonable belief that this marketing does not include any false or material misleading information statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.