When it comes to retirement planning, there are three major risks to address:

- Longevity risk (outliving your money)

- Market risk (investments underperforming)

- Spending shocks (unexpected large expenses)

Long-term care is one of the biggest spending shocks a retiree can face. According to Genworth’s 2024 Cost of Care Survey, the national median annual cost of a private nursing home room is now $127,750, up 9% from the year before.

Over 70% of people age 65 or older will need some form of long-term care. Most claims occur in people’s 80s. On average, women need 3.7 years of care, while men need 2.2 years.

What is Long-Term Care?

Long-term care refers to help with activities of daily living (ADLs) such as:

- Bathing

- Dressing

- Toileting

- Transferring (getting in/out of bed or chair)

- Continence

- Eating

There are several types of care:

- Home care for assistance in your own home

- Assisted living facilities that promote independence with support

- Nursing homes that provide 24/7 skilled care

- Adult day care centers that offer daytime support and respite for caregivers

I suggest using the Genworth Cost of Care calculator to estimate care costs in your area.

How Do You Pay for Long-Term Care?

1. Government Programs

- Medicaid covers long-term care only for people who meet strict income and asset limits.

- Veterans Affairs (VA) benefits may help veterans with service-connected needs.

- Medicare does not cover long-term care beyond short-term skilled nursing.

Some states have Long-Term Care Partnership Programs, which let you keep assets equal to the amount of private coverage you buy, and still qualify for Medicaid if your policy runs out. These programs can help protect your estate while managing costs.

2. Traditional Long-Term Care Insurance

These policies provide a specific daily or monthly benefit, usually with a set term (such as three years), and an elimination period (similar to a deductible measured in days). Policies typically range from $150,000 to $300,000 in total benefits.

Work with a financial or insurance professional to choose a benefit amount, inflation protection, and duration that makes sense for you.

3. Hybrid Life and Long-Term Care Insurance

Pros:

- You won’t “lose” your premiums if care isn’t needed

- Premiums are typically fixed

Cons:

- More expensive than traditional policies

- Smaller benefit relative to cost

- Limited investment growth compared to self-insuring

If you’re healthy and want flexibility, a traditional policy plus additional savings may give you more buying power. However, hybrid policies are often easier to qualify for and can offer peace of mind. Many people choose hybrid policies so that they or their family are sure to receive something for their premiums eventually– either in payments toward care or in a death benefit or to avoid the risk of rising premiums in a traditional plan.

4. Personal Savings (Self-Insuring)

You may choose to self-insure by covering care costs out of pocket. This could mean drawing from your investment portfolio or using home equity as a backup plan.

At Together Planning, we stress-test each client’s plan at various long-term care cost levels to determine whether insurance is needed or if they can afford to self-insure.

When Should You Buy Long-Term Care Insurance?

Most people who purchase coverage do so between age 50 and 60. Waiting too long increases the chance that a health issue could disqualify you.

Your decision should consider:

- Health and family history

- Current savings and ability to self-insure

- Home equity and willingness to use it

- Age gap between spouses

- Emotional comfort level with uncertainty

- Ability to afford rising premiums

There is no one-size-fits-all age, but planning before health issues arise gives you more options.

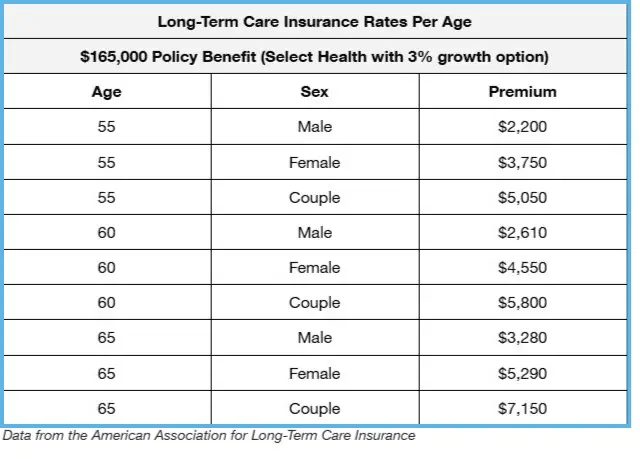

How Much Does Long-Term Care Insurance Cost?

Costs vary by age, sex, benefit amount, inflation protection, and other features. Below are 2025 average annual premiums for a $165,000 straight long-term care policy (no death benefit) with 3% compound inflation protection:

Putting It All Together

Long-term care is one of the biggest financial unknowns in retirement. Some people will never need it. Others will need it for several years. You can reduce the risk by:

- Saving more

- Exploring standalone or hybrid policies

- Setting aside home equity as a contingency

- Planning early while you’re still healthy

Everyone’s situation is different. This is one of those areas where working with a financial planner and insurance professional can help you find the best solution for your needs.

Have questions about long-term care planning or whether insurance makes sense for you?

Use our Contact Us form to schedule an introductory consultation and get answers tailored to your situation.

Together Planning is a registered investment advisor. The information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Together Planning has a reasonable belief that this marketing does not include any false or material misleading information statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.