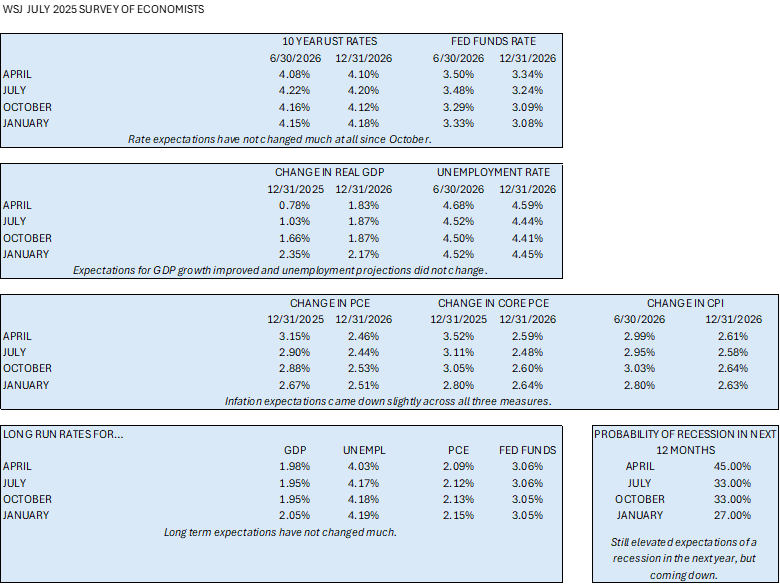

With all the chaos and volatility we saw in 2025, economic data has not changed significantly since our last quarter economic report. Equities and bonds both delivered positive returns. The Federal Reserve’s FOMC dot plot released in December as well as the January Wall Street Journal survey of economists showed no statistically significant changes. For three consecutive quarters the results have remained essentially unchanged.

There is some noise this quarter in the consumer sentiment numbers. The University of Michigan Index of Consumer Sentiment was slightly improved from December but remains well below (21.3%) its level in January 2025. The Conference Board, on the other hand, showed a marked drop (9.4%) in consumer expectations in January. More discussion of this later.

And most importantly, my forecast for holiday sales was more accurate than the professionals’. Whereas they forecasted a decline, my expectation that the American consumer would spend was realized. Holiday sales growth is reported at 4.1% over last year and rest assured the Mallini family contributed to this growth!

GDP Continues to Grow

The Atlanta Fed produces a preliminary GDP estimate called GDPNOW. On December 23rd the estimate for the fourth quarter of 2025 was growth of 3.0%. On January 26th it was growth of 5.1% as the Mallini family contribution was revealed! On a more serious note, Chairman Powell in his January 28 news conference said, “the economy expanded at a solid pace last year and is coming into 2026 on a firm footing…job creation has been low, but the unemployment rate has stayed low…inflation remains somewhat elevated”.

Corporate Earnings are Healthy

Corporate earnings remain healthy. Through January 30th, 33% of S&P companies have reported. 75% beat forecasts, compared to third quarter 2025 of 77%. These high percentage of “beats” might lead one to conclude that either the economy is far exceeding our expectations or that analysts do a poor job of estimating future performance. Analysts typically issue estimates that are conservative. What is important is that the companies beat the estimate. A sharp increase of “misses” of their conservative estimates would be a real red flag for economic outlook. In the fourth quarter of 2025, the aggregate reported earnings exceeded estimates by 9.1% compared to 5.0% in the fourth quarter of 2024. So, the business community remains healthy.

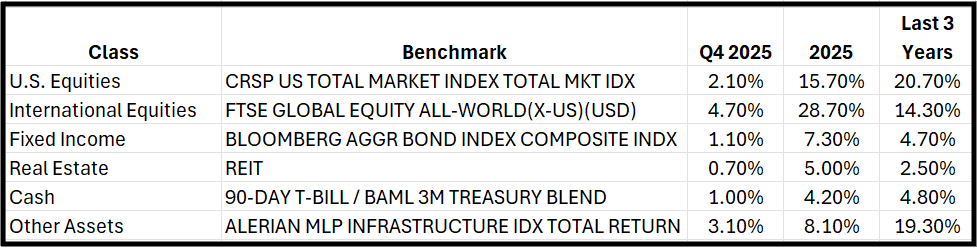

Markets Delivered Positive Returns in Q4 and in 2025

Consumer Sentiment Data is Mixed

The health of businesses and our economy are driven, to a very large extent, by consumer consumption. As mentioned earlier, The University of Michigan survey of consumer sentiment for January 2026 improved slightly over December but remains significantly below January 2025. This improvement was modest but broad based across incomes, education, age and political affiliation. This is good. Primary concerns expressed were continued pressure on purchasing power and weakening labor markets.

On the other hand, The Conference Board survey released January 27, 2026, stated “Confidence collapsed to its lowest point since 2014, surpassing pandemic depths.” This got my attention. Dana M. Peterson, Chief Economist of The Conference Board said, “Confidence collapsed in January, as consumer concerns about both the present situation and expectations for the future deepened. All five components of the index deteriorated, driving the overall index to its lowest level since May 2014 (82.2) —surpassing its COVID-19 pandemic depths.”

What drove this divergence between the two surveys? I don’t pretend to know the reason but apparently their methodologies are different. The Conference Board’s survey pool is significantly larger than Michigan’s. What I learned is that Michigan’s focus and weighting emphasizes household finances such as personal purchasing power, the impact of inflation, and buying conditions for big ticket items. The Conference Board skews more toward labor market conditions and is often more sensitive to employment trends. As we have seen, recent new jobs creation is significantly below historical numbers. Click the links below if you would like to review the full reports.

The University of Michigan Survey of Consumers

The Conference Board’s Consumer Confidence Survey

Economic Forecasts are Essentially Unchanged

For all the chaos and political mayhem we have experienced lately, I don’t feel like I have a lot to report this quarter, and that’s probably good. I will be reviewing the consumer surveys because I know that consumer spending drives our economy and if a significant trend develops, positive or negative, we will let you know.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Together Planning has a reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Any economic forecasts set forth may not develop as predicted and are subject to change. Any references to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Market projections or investment growth, including those in examples, are not indicative of future results, should not be considered specific investment advice, do not take into consideration your specific situation, and do not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk, including changes in market conditions, and are not guaranteed. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein. Together Planning is a SEC registered investment advisor.