“In the world, nothing is certain except death and taxes.” -Benjamin Franklin

Tax planning is a key component of financial planning, and we use a cutting edge product called Holistiplan to reduce the lifetime tax burden for our clients.

You may have noticed the word “lifetime” in the preceding sentence. Did you know that in retirement it may be best not to try to minimize your tax bill in the early years?

With marginal tax rates at historic lows, and with many people retiring in their early 60s with large 401(k)s and traditional IRAs, it can make a lot of sense to structure a plan to reduce those balances and pay a little more in tax in the early years to significantly reduce the tax bill over your lifetime.

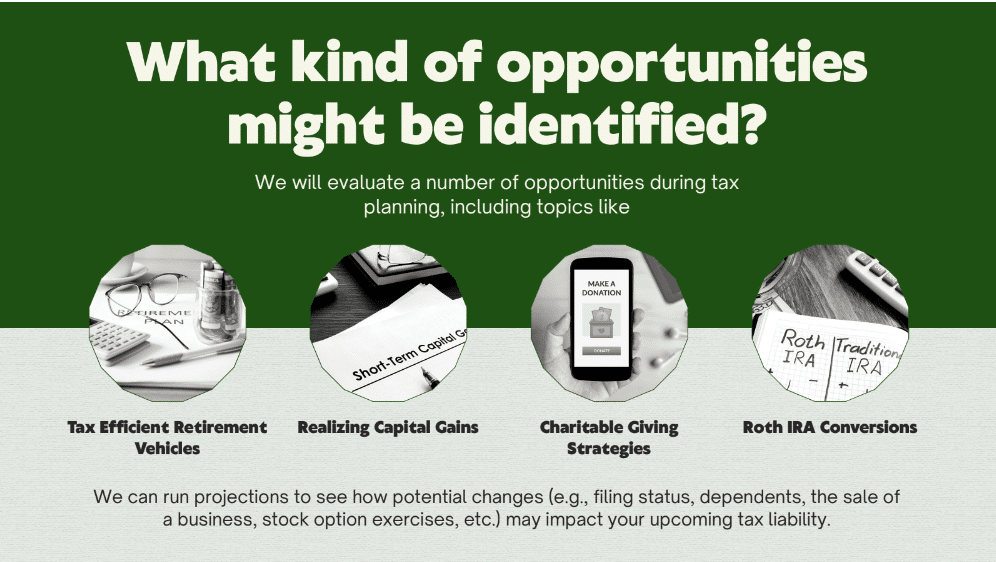

Holistiplan allows us to do powerful tax planning for our clients. While we don’t prepare tax returns or give tax advice on specific novel questions (you will still need your CPA for that), we can provide tax planning to help you take advantage of settled tax law to minimize your tax burden over your lifetime.

With Holistiplan, we can de-mystify your current tax situation and show you clearly where your income falls with respect to various tax brackets, credits and phaseout ranges. Then, we can model scenarios to show what your tax bill might be next year, and how you might want to “fill up” a bracket now to reduce taxes later.

We can plan for realization of capital gains, using tax deferred accounts for current income, or implementing a Roth conversion strategy in the early years of retirement. If you are selling a business, or if you will have payouts from deferred compensation plans, Holistiplan will allow us to plan for those higher income years and find ways to reduce the tax burden over time.

Together Planning is a registered investment advisor. The information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Together Planning has a reasonable belief that this marketing does not include any false or material misleading information statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.