Hello and welcome to tax season!

Everyone at Together Planning works hard all year helping our clients prepare for taxes, because taxes are more than a once-a-year obligation. They are an essential part of year-round, holistic financial planning.

You may have already received your 2024 Tax Letter from us either by paper mail or through your client portal. If you haven’t, you will be receiving it soon. This is the first year we have created this letter, which seeks to outline what documents you will need to gather and what information will be important for you to convey to your tax return preparer. We hope this letter is of great value to you. Since we are often the advisor our clients interact with the most, we often know the most financial details about them come tax time. Consider us the quarterback of your team, and we are in the red zone almost over the goal line.

Taxes can be complex. We try to make them less complex for you. Some of the tax topics that we consider important with regard to our financial planning advice include:

1. Proactive Retirement Planning

Effective tax management of retirement accounts should be viewed as a year-round strategic priority. While retirement accounts offer significant tax advantages, maximizing these benefits is not the only consideration. Current income, expected income in the future, various life events, and aligning the timing of contributions versus other investments requires ongoing attention and planning over a lifetime. Whether you are early in your career, approaching, or already in retirement, there are tax considerations to be aware of.

Proactive tax planning helps optimize both retirement account contributions and withdrawals.

Tax considerations become even more critical during retirement, particularly regarding Social Security and Required Minimum Distributions (RMDs).

2. Tax-Advantaged Strategies

Tools like Health Savings Accounts (HSAs), Roth conversions, backdoor IRA strategies, Donor-advised funds, and Qualified Charitable Distributions are popular for tax planning.

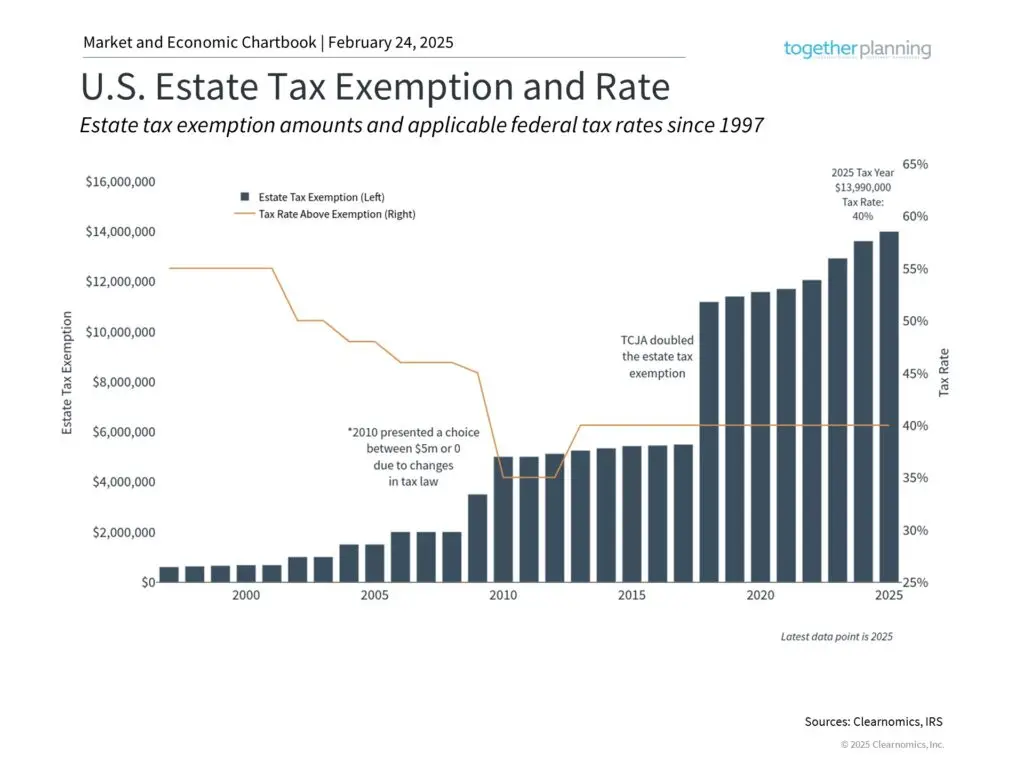

3. Plan for Your Legacy

Estate planning is a critical component of comprehensive financial planning, and knowing if your beneficiaries will face estate taxes is important.

These tax laws change often.

A holistic approach integrates estate planning and tax efficiency. It may even consider philanthropy and charitable goals. By taking a proactive stance on wealth transfer planning, families can potentially optimize their tax position while ensuring their legacy wishes are fulfilled.

A well-structured wealth transfer plan often incorporates various tools and techniques, from basic estate planning documents to more sophisticated trust arrangements. The complexity of these options, combined with varying state-level regulations and tax frameworks, makes professional guidance invaluable in developing and maintaining an effective strategy.

4. Investment Tax Implications

Just as investors often focus on capital gains management and tax-loss harvesting near the end of the year, the start of the new year can present opportunities as well. It’s important to consider both to maximize tax efficiency and maintain a well-balanced portfolio.

Equity compensation, such as Restricted Stock Units, Stock Options, Employee Stock Purchase Plans, etc. can have important tax implications.

Next, it is smart to take stock of financial needs for the current year. If there are any large expenses, charitable giving, or estate planning needs expected in the coming year, a review of the most tax efficient funding sources should be reviewed. This is also a good time to discuss diversification of a portfolio across asset classes, including optimizing your assets for tax efficiency, as well as considering concentrated investment exposure via small business ownership or individual stocks. In other words, it is never too early to prepare for the next tax year.

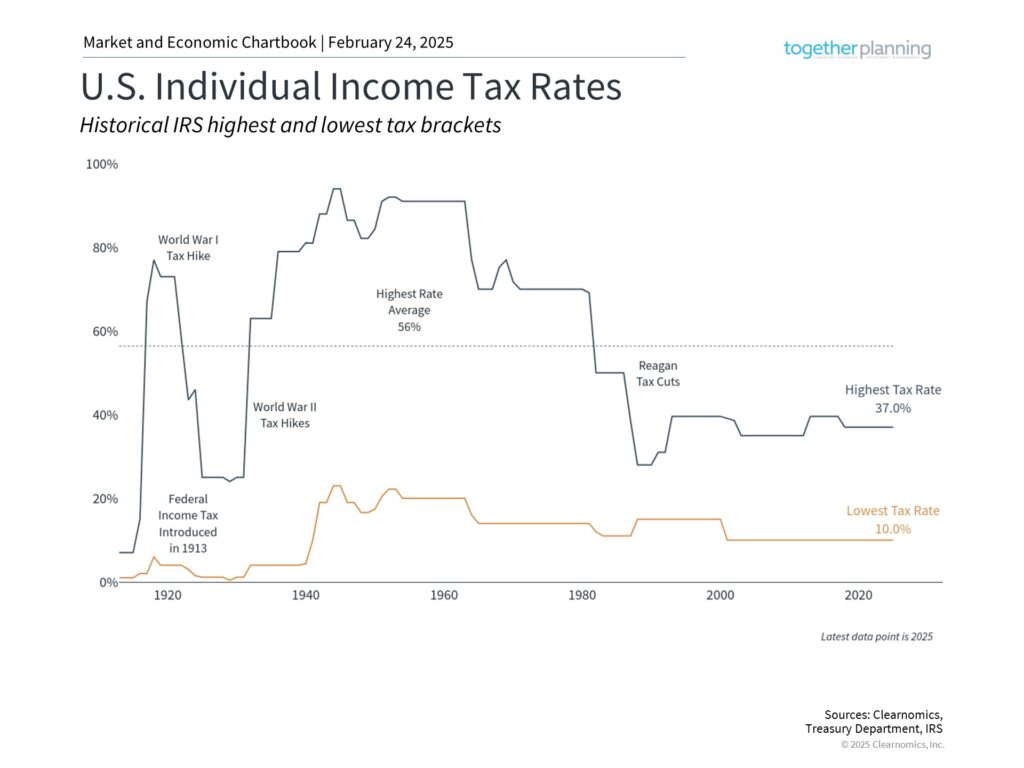

5. Prepare for Future Tax Obligation Uncertainty

The tax landscape continues to evolve. We recommend taking a flexible approach to tax planning and consider multiple scenarios when making long-term financial decisions.

Thank you for allowing us to help you prepare for tax season. Please let us know how we can improve our value to you.

– Your Together Planning Team

Together Planning is a registered investment advisor. The information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Together Planning has a reasonable belief that this marketing does not include any false or material misleading information statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.