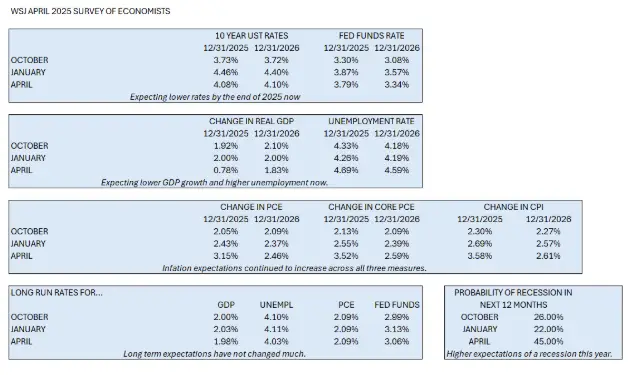

So far in 2025, U.S. stock indexes are down while bonds and international stocks are up. After a positive 3% return in January, U.S. stocks returned -2% in February, -6% in March and -0.7% in April. What’s a soul to do during these “periods of market unpleasantry?” Markets should be, but are not always, driven by the health of the economy. We always like to ask, “what do professional economists think?” As you can see in the chart below, the 75 economists participating in the Wall Street Journal quarterly survey are in fact a little more pessimistic in April than they were in the two prior quarterly surveys. They are predicting slower growth and continued inflationary pressure caused primarily by the implementation of widespread tariffs. If this does occur, the Federal Reserve Board’s job becomes harder. Their dual mandate of controlling both inflation and unemployment is more difficult in a slowing economy with rising prices.

In a message we sent to you April 4th, we said we wanted to research periodic consumer sentiment surveys to learn how consumers feel about their financial health and their expectations for the future. Consumer spending comprises almost 70% of U.S. Gross Domestic Product (GDP). If consumers are worried about their future income, inflation etc., then we would expect their spending to decline, causing a slowing in GDP. So, we researched the work of the University of Michigan and The Conference Board.

The University of Michigan report stated: “Consumer sentiment fell for the fourth straight month, plunging 8% from March…the expectations index plummeted with drop-offs in personal finances as well as business conditions.”

The Conference Board’s report stated: “Consumers’ expectations for the future are at a 13-year low.” “Consumer confidence declined for a fifth consecutive month in April, falling to levels not seen since the onset of the COVID pandemic.”

We also found a Federal Reserve Bank FEDS Notes dated April 24, 2025 titled “Tracking consumer sentiment versus how consumers are doing based on verified retail purchases”. I am glad we did because it points out a conflict. Sentiment surveys are showing that consumers are feeling less optimistic about their financial future but this has not affected their spending so far.

It reports “we link survey responses to respondents’ total annual spending to gauge how actual spending and household-specific price levels for everyday retail purchases changed between 2019 and 2024.”

The results indicated that:

- The more people thought the prices they paid rose faster than their incomes, the worse they said they were doing.

- Consumers were more likely to overestimate than underestimate the inflation they experienced. Those consumers that overestimated their verified inflation said they felt worse about economic conditions.

- Most households reported higher household incomes in 2024 versus 2019, but still said they did not feel good about the economy.

- After adjusting for inflation, verified spending on everyday retail items remained strong even among those who reported having lower incomes or among those who said they felt worse about the economy in 2024 compared with 2019.

“Taken together, we show that what consumers have been saying differs from what they have been doing.” “While it is important to recognize how consumers feel, we should exercise caution when using consumer sentiment surveys to infer future behavior given this recent disconnect between what consumers say and do.”

So, what do we know today?

- Consumer surveys are not as reliable as they have been in the past. Consumers are doing better than they feel like they are doing, and spending hasn’t slowed down as confidence has declined.

- Unemployment is still relatively low.

- The consumer is still relatively healthy. Retail sales for the first quarter were up 4.1% according to the Conference Board.

- Corporate earnings for the first quarter of 2025 are looking healthy. As of 4/25/2025, with 36% of the S&P 500 companies reporting, 73% are posting. positive EPS surprises and 64% are posting positive revenue surprises.

- Stock markets have recovered about 60% of the losses felt after tariffs were announced in early April.

So, what do we not know?

- Where tariff levels will end up.

- What impact they will have on inflation, interest rates, GDP, unemployment.

- What the resolution with China will look like.

- How U.S. trade policy will change in the near term.

We are definitely going through a period of “market unpleasantry.” But, our underlying economy is currently healthy as we enter this period. Last week I visited Mt. St. Helens in Washington. Our guide said the 1980 eruption reduced the height of the mountain by more than 1300 feet. Millions of cubic yards of debris were scattered over hundreds of square miles. Essentially all plant and animal life in the worst zones were destroyed. In less than 90 days, new plant and animal life was growing on the ground and in the streams. We will get through this.

Thank you for your trust and your business.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Together Planning has a reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Any economic forecasts set forth may not develop as predicted and are subject to change. Any references to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Market projections or investment growth, including those in examples, are not indicative of future results, should not be considered specific investment advice, do not take into consideration your specific situation, and do not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk, including changes in market conditions, and are not guaranteed. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein. Together Planning is a SEC registered investment advisor.