We often come across clients and prospects who have never heard of Socially Responsible Investing (SRI). Additionally, if people have heard of it, they often have misconceptions about it.

One problem is that it is a discipline that goes by many different names. You may have heard of “impact investing,” “sustainable investing,” “ethics investing,” “values investing,” “ESG investing (ESG stands for Environmental, Social, Governance),” or another similar term.

You might be tempted to assume that it is all about the “sustainability” in terms of climate change. Protecting the environment is one of many varied objectives of SRI investing.

In 2003 the U.S. Conference of Catholic Bishops published a comprehensive protocol of SRI for conference investing. Check out these guidelines. So, this is not a new field. Read this short history of SRI on www.thebalance.com and learn that it has roots in both Sharia investing and in the Methodist church, and that it grew significantly in the latter half of the last century with the civil rights movement, opposition to Apartheid, and concern for the Earth. Here is a quote from the article:

“John Wesley, the founder of the Methodist movement, urged his followers to shun profiting at the expense of their neighbors. Consequently, they avoided partnering or investing with those who earned their money through alcohol, tobacco, weapons or gambling – essentially establishing social investment screens.”

The social investment screens referenced here can be positive or negative. A negative screen would mean avoiding companies that deal in alcohol, tobacco, weapons, gambling, fossil fuels, or any other controversial enterprise. A positive screen would lead to heavier investments in companies with diverse leadership teams, a commitment to clean energy, strong fair labor practices, or other desirable policy.

There are many different approaches to SRI

1. You can choose to eliminate certain industries or companies completely. For example, some investors want to avoid any ownership at all in gun manufacturers or fossil fuels.

2. Perhaps you don’t want to avoid an industry altogether, but you want to invest in the companies within that industry with the most sustainable practices. For example, you want some exposure to the oil and gas sector for diversification’s sake, but you want to avoid companies that have had major oil spills or that have drilled in sensitive regions.

3. Another way to have a meaningful impact is to actively participate in proxy voting as a shareholder. You can propose initiatives or vote on the ones that others propose. Real changes are made at the corporate level due to these initiatives.

SRI is getting easier as the field grows

Fund managers and investment companies have responded to growing interest in SRI by establishing many new low-cost ETFs (exchange-traded funds) and mutual funds with a focus on sustainability. We use many of these funds in SRI portfolios for our clients.

Some of these funds are designed to track an index but exclude certain companies with environmental, social, or governance risks.

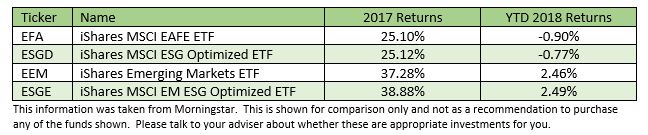

If you follow a prescribed asset allocation for your risk tolerance and time horizon, you may be able to just substitute certain SRI funds for those that are already in your portfolio. Here is an example of two conventional ETFs from BlackRock iShares funds family, and their ESG counterparts. As you can see, the returns are substantially similar.

What would you include in your Impact Investing Policy Statement? What would you avoid in your portfolio if you could? What would you like to invest in more heavily? We would love to work with you to help you align your investments with your values.

For more about our investment management practice, click here.