You’ve built a plan, started investing in the right accounts, and chosen a mix of low-cost, globally diversified investments. Now it’s time to talk about one of the most important parts of your retirement income:

Social Security

When you claim benefits can have a significant impact on your lifetime income, your surviving spouse if you’re married, and your tax planning. In this post, we’ll walk through what you need to know to make a smart claiming decision.

Countless books and articles have been written on this topic. I’m not here to reinvent the wheel or offer a secret strategy no one’s heard of. My goal is much simpler: to clear away the confusion and help you understand the key principles behind when and how to claim. This post is meant to be a general, educational overview and not an exhaustive guide to every possible Social Security scenario. There are plenty of exceptions and edge cases, but covering them all would only make things more confusing.

If you’re interested in digging deeper, I highly recommend Mike Piper’s excellent book Social Security Made Simple. He’s also built my favorite free Social Security calculator OpenSocialSecurity.com.

What is Social Security and Why It Matters

Social Security is designed to supplement retirement income. It was never meant to be the only source of income in retirement, but more than a third of Americans report relying on it for the majority of their income.

To qualify for retirement benefits, you need to be at least age 62 and have earned 40 Social Security credits. In 2025, you earn one credit for every $1,810 in income that is subject to Social Security taxes, with a maximum of four credits per year.

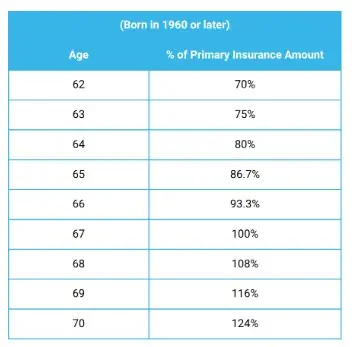

Your monthly benefit depends on your earnings history and the age at which you claim. If you claim before your full retirement age (FRA), your benefit is reduced. If you wait to claim after your FRA, your benefit increases above your primary insurance amount (PIA) through delayed retirement credits.

There’s also a spousal benefit available for lower- or non-earning spouses, provided their partner qualifies for benefits based on their own work history.

Your full retirement age depends on the year you were born. For most people today, it falls between age 66 and 67.

Social Security is also adjusted annually for inflation, based on the CPI-W*. This makes it one of the most valuable retirement income sources available: it is government-backed, inflation-protected, and guaranteed for life. These features make it especially powerful for managing the risk of living a long time.

Why Delaying Often Makes Sense

With so many numbers and so much riding on the decision, figuring out when to claim can feel overwhelming.

Fortunately, in many cases, the best option is to wait. Here’s why that usually works well:

- You receive a higher monthly benefit for life

- You protect against the risk of living a long time

- Your surviving spouse may receive a larger benefit after your passing

- You open up more opportunities for tax planning in your 60s before Required Minimum Distributions begin

There are really two risks to consider. The first is dying early after delaying, which means you would not have received benefits for as many years. The second is living a long time after claiming early, which means you gave up a higher monthly benefit for decades.

Of these two, living a long time with too little income is clearly the bigger risk. If you pass away sooner than expected, you miss out on some benefits, but you won’t be around to feel the consequences. If you live a long life, however, every additional dollar of guaranteed, inflation-adjusted income becomes more valuable.

There are cases when claiming early can make sense. These include needing the income to support your retirement, facing health issues, planning around legacy goals, or bridging income before a future liquidity event. Every person’s situation is different, which is why it helps to model your options with a professional before making your decision.

Common Social Security Claiming Examples - Married Couples

Higher Earners Should Delay

For married couples, it almost always makes sense for the higher-earning spouse to delay until age 70. If they pass away first, the surviving spouse steps into that larger benefit. This creates the highest possible income stream for the remainder of the surviving spouse’s life.

Similar Benefits – Probably Both Delay

If both spouses have similar benefit amounts, delaying for both may make sense. That maximizes the income you receive while you are both alive.

Lower Earners have Flexibility in Choosing

If one spouse has a lower benefit, the decision becomes more flexible. Since the surviving spouse receives the larger of the two benefits, the lower benefit does not stick around. This makes the lower earner’s claiming date less critical. Delaying still increases income while both of you are alive, and may make sense for tax planning purposes. However, some couples choose to have the lower earner claim earlier to hedge against the possibility of an early death. This decision depends on the specifics of your situation, including health, income needs, and personal goals.

Common Social Security Claiming Examples - Single Individuals

If you are single, the decision is usually more straightforward. In most cases, it is best to wait until age 70.

Unless you have serious health concerns or a clear reason to claim early, delaying will provide the highest total benefit over your lifetime. This is especially true for high-earning women and anyone with a family history of longevity.

From a breakeven standpoint, you generally need to live until around age 80 or 81 for delaying to make financial sense. According to government statistics, a 62-year-old woman today has an average life expectancy of nearly 85, while a man has an average life expectancy of over 82. That means the average person will live long enough for waiting to pay off.

Even if you are unsure how long you will live, the greater risk is outliving your money, not dying too soon.

Additional Benefits of Delaying

Delaying your benefit also has some important tax advantages.

First, up to 15 percent of your Social Security income is always tax-free. If you delay, you are creating a larger source of partially tax-free income.

Second, by waiting to claim, you create what are sometimes called “gap years” between when you retire and when your benefits begin. During these years, you may be in a lower tax bracket, which gives you the chance to perform strategic Roth conversions or harvest capital gains at favorable rates. This can help reduce future required minimum distributions and shift more of your wealth into tax-free accounts.

Recap and What to Do Next

Here are the key takeaways from this post:

- The longer you wait to claim Social Security, up to age 70, the higher your benefit will be.

- For married couples, the higher-earning spouse should almost always delay.

- The lower-earning spouse has more flexibility and can claim earlier depending on your overall plan.

- For single individuals, delaying until age 70 usually provides the most income and protection against longevity risk.

- Delaying also opens up powerful tax planning strategies during your 60s.

There are exceptions to these guidelines, including health concerns, spousal age differences, and legacy goals. But in most cases, the decision to wait will strengthen your retirement plan.

Don’t guess. Run the numbers. Social Security is too important to leave to chance.

If you are nearing retirement, now is the time to revisit your Social Security strategy and make a decision that supports the rest of your plan. And if you are not sure how to model it on your own, working with a financial professional can help you make a confident, informed choice.

*CPI-W is a specific subset of the broader Consumer Price Index (CPI) that measures the average change over time in the prices paid by urban wage earners and clerical workers for a market basket of consumer goods and services.

Together Planning is a registered investment advisor. The information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Together Planning has a reasonable belief that this marketing does not include any false or material misleading information statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.