Last Friday the IRS announced a few increases to retirement plan contribution limits for 2025:

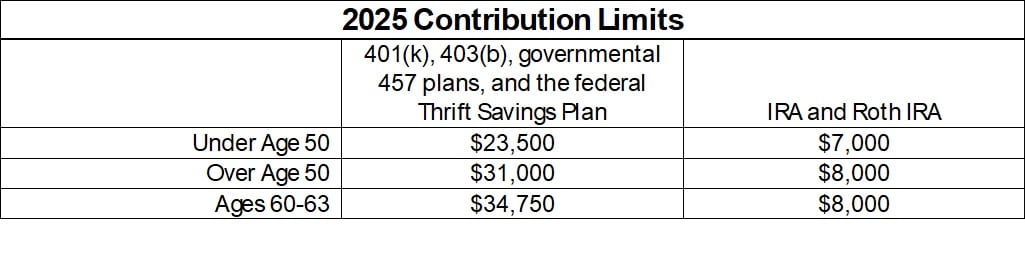

For employees who participate in 401(k), 403(b), governmental 457 plans, and the federal government’s Thrift Savings Plan, the deferral limit to those plans will increase to $23,500, up from $23,000.

The catch-up contribution to these plans for workers aged 50 and above will remain constant at $7,500. However, a brand new additional catch-up contribution of $3,750 will be available for workers ages 60, 61, 62, and 63.

For IRAs and Roth IRAs, the maximum contribution will remain $7,000 and the catch-up contribution for workers aged 50 and above will remain $1,000.

Along with these adjustments to contribution limits, the phaseout ranges for eligibility for various deductions and credits have also been adjusted. You can find the full release on the IRS website here.

If you have provided your 2023 tax return to us for tax planning, we will be incorporating these new limits to any scenario we build for you for 2025. If you haven’t uploaded it, it is not too late! Upload it to your portal now and we will get back to you with an updated tax planning report and a plan for 2024 and 2025.

Together Planning is a registered investment advisor. The information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Together Planning has a reasonable belief that this marketing does not include any false or material misleading information statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.