Inflation, national debt, deficit spending, GDP, productivity, how does a person sort through and make sense from all this data?

In 1966, I was a high school senior, and I recall an economics lesson my father delivered to me at the breakfast table one morning. His focus was deficit spending, and his position was that you can’t do this forever. You can’t spend more than you earn, as a nation, except in a period of national crisis, such as World War II. This memory came back to me as I thought about our economy in the first quarter of 2024. I became curious as to how these economic data points had evolved over my lifetime.

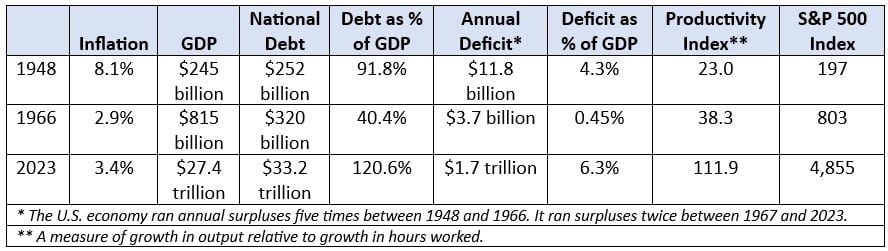

I was born in 1948, and since my Dad’s 1966 economics lesson, here is what I found:

What do I conclude from all of this?

Debt and deficit spending are engrained in our economy and, while one can never say never, I don’t see how this will change in my lifetime. I can remember in the early 1980s when we saw residential mortgage rates at 14% and said we will never again see a single digit residential rate. Obviously, we were wrong.

Our economy is strong and resilient. US GDP is approximately 26% of total global GDP. So, something works. To understand this, I look at the increase in productivity which is phenomenal. However, we must continue increasing productivity for this formula to continue to work.

So, how about the first quarter of this year?

Inflation remains stubbornly above the Feds 2% target in the first quarter of 2024 as Personal Consumption Expenditures came in at 3.7%. This is a reversal of the trend we saw developing in the last half of 2023 when inflation was trending toward 2%. On a macro level, the US economy remains strong and resilient despite the lower than expected 1.6% growth in GDP for the first quarter of 2024. This conclusion is supported by a below 4% unemployment rate, continued strong consumer spending along with the fiscal stimulus provided by deficit government spending.

However, the economy may be approaching an inflection point as consumer spending has been buoyed by a decline in personal savings and an increase in credit card usage. Also, an increase in credit card delinquencies may be a sign that consumer spending may decline in the next few quarters as buying power declines. In fact, GDP for the first quarter of 2024 grew less than expected at 1.6%.

When we entered 2023 markets believed strongly that inflation would continue its downward trend thereby allowing the Fed to begin cutting rates as early as March with possibly three cuts in the year. A fourth quarter economic survey put the probability of no rate cuts in 2024 at less than 1%. That probability today stands at 19%. So, we have seen a shift in sentiment and expectations. While we recognize a Fed approach of “higher rates for longer” as the headwind that it would be, it is important to also recognize the strength and resilience of the US economy. Our economy came through the pandemic intact and today comprises approximately 26% of total global GDP.

Debt to GDP has also grown significantly and it is important to realize the potential threat to growth that this brings. But the US economy is very productive and continued growth in productivity can help offset the negative threats that an increase of the ratio of debt to GDP presents. Productivity grew 2.3% in 2023 and peaked at 4.9% in the third quarter. Continued increases in productivity are essential to buffering the impact of excess fiscal stimulus.

The economy is going through another cycle of expansion and contraction as it has done throughout history. Although there is some difference of opinion, most economists count 48 recessions to our economy since adoption of the Articles of Confederation in 1777. Restrictive policy has not yet done its job, but inflation will subside. The amount of economic pain required to get back to 2% is yet to be determined but we will get there.

This is made perfectly clear by Chairman Powell’s remarks on May 1st after this month’s FOMC meeting. He repeatedly emphasized the Feds commitment to bringing the inflation rate down to 2%. In response to a question, he stated that 3% inflation cannot be used in the same sentence with satisfied. He acknowledged that based on the first quarter data, the path to get to 2% will be longer than previously thought. He further stated that there were signs in the first quarter that progress was being made and that it was “unlikely that the next rate move would be a hike”. As is customary, he emphasized that the timing and direction of rate changes are always “data dependent.”

The outlook for both stocks and bonds is positive for 2024. A strong economy, as noted by Chairman Powell on May 1st, accompanied by tight inventories and corporate pricing power, will bolster stocks. The inevitable and eventual cut in interest rates will boost bond prices as the bond market typically sees higher returns between the last Fed rate hike and its first cut.

So, what should an investor do?

Review with your advisor your investment strategy considering your goals, objectives and time horizon. Changes should be made based on changes in these three components to your financial plan. Not on the outlook for this great US economy!

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Together Planning has a reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investments, or client experiences. Together Planning has a reasonable belief that the content will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Any economic forecasts set forth may not develop as predicted and are subject to change. Any references to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Market projections or investment growth, including those in examples, are not indicative of future results, should not be considered specific investment advice, do not take into consideration your specific situation, and do not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk, including changes in market conditions, and are not guaranteed. Be sure to consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein. Together Planning is a SEC registered investment advisor.