Two years ago, my husband and I decided to leave the group health plan that we used through his company and try an Affordable Care Act (ACA) health plan through the Marketplace. You can read all about that decision and how our first year using the ACA plan went by reading this blog post from 2020.

Here is the backstory in a nutshell:

- Neither my husband or I have health premiums subsidized by an employer (we are both partners in our firms and are considered self-employed).

- Our premiums under my husband’s group plan were increasing 8-12% every year and seemed high, even though we always chose the high-deductible HSA (Health Savings Account) eligible plan.

- For the 2020 plan year, we confirmed that our key physicians were in-network for an HSA eligible plan on the Marketplace, and we made the switch.

Two years later, we are preparing to enroll in the same ACA Marketplace plan for 2022 and we have no regrets. In fact, next year we will save even more money than when we first left the group health plan.

Before I go into the details about how much money we save, I need to make a few disclaimers about our situation:

- Our ACA Marketplace plan offers in-network coverage only. Our key providers are in network, but we may be limited in our choices if we needed to seek additional care. If we had stayed with the group plan, we would still have some benefit with out-of-network providers (with a higher deductible and maximum out of pocket limit).

- We didn’t consider any plans that are not HSA-eligible (in either the group benefits menu or on the Marketplace), so I am only comparing two options here. These may not be the best options for everyone. You can read here about why HSA eligibility is important to me, but also know that the amount we save in premiums is enough to fully fund an HSA (and still have money leftover).

- We do have some pre-existing conditions in our family, which is why ACA compliance matters to us. Non-compliant plans don’t have to cover any pre-existing conditions, so many such plans exclude those conditions from coverage for some initial period (6 months seems common). This would not be a huge deal for us, since none of our conditions are serious, but it means we would pay out of pocket for any doctor visits or prescriptions related to those conditions for some period of time if we used a plan that was not ACA compliant. At this point we don’t feel the need to consider those plans.

- We use the Marketplace health plan’s pharmacy by mail for all recurring prescriptions (we have six in our household) and we use Good Rx coupons (available to anyone for free!) when we need a prescription from a local pharmacy.

- We are in Georgia. I am not an expert on the plans here– I can only speak to the one I use. The plan I use may not be available in your state.

Updates: What is changing for 2022?

We just received the open enrollment information for the group plan that we no longer use. We also received the premium for our Marketplace plan in 2022 if we decide to keep it. While the group premium has gone up 13% in the two years since we switched, our Marketplace premium will be 2% lower next year, (for a net 7% increase from when we first switched).

The deductible and max out of pocket limits for the Marketplace plan are increasing next year (from $7,000 to $7,050 per individual, and from $14,000 to $14,100 per family). The deductible and max out of pocket have not changed for the group plan. I consider this to be a very minor change, especially considering that our premiums will also be lower.

Our annual savings on healthcare premiums will be $13,660 in 2022 by using the Marketplace plan instead of the group plan that is available to us. These saving are enough to fully fund our HSA (the limit is $7,300 for a family in 2022) and set aside another $6,360 for emergencies. If we don’t have a lot of health costs, we will be able to invest the full $13,660 for long-term growth. If we do have health costs, we will have that cushion of excess cash to help us pay for them.

But will the savings be enough to cover potentially higher costs?

The maximum out-of-pocket limit on our Marketplace plan is $7,050 per individual or $14,100 per family. Right away simple math tells us that the family limit of $14,100 is barely more than the amount we are saving on premiums ($13,660), but it is not quite that simple. I felt the need to dig into the numbers and prove to myself that there is no situation where we would be worse off with the Marketplace plan for in-network care.

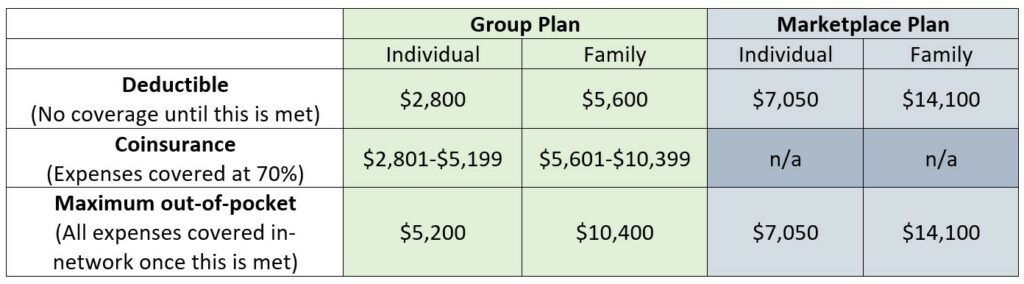

There are a couple of other numbers we need here to do this math. While the Marketplace plan has only two phases of coverage (0% before the deductible is met and 100% after it is met), the group plan has three phases (0% until the deductible is met, then 70% until the maximum out-of-pocket limit is met, and then 100% thereafter). Here are the numbers in a table for those of us who need to see it in neat rows:

I ran several examples of possible health expense levels to see what the “worst case scenario” would be for choosing the Marketplace plan over the group plan. By “worst case,” I mean the level of expenses where we would save the least amount of money over the group plan. We already know that we will save $13,660 on premiums, but there is potential for that savings to be offset by higher costs for care, since the deductible and maximum out-of-pocket expenses are higher in the Marketplace plan.

The least optimal level of expense is right at the deductible amount in the Marketplace plan. At that level, we have received no benefit from the insurance, whereas we would have received a benefit by that point in the group plan. But is the difference enough to offset the premium savings?

In the “worst case scenarios” below, we are looking to see if it would ever be possible to spend more than $13,660 MORE for out of pocket expenses in the Marketplace plan than in the group plan (again, this is all for in-network care).

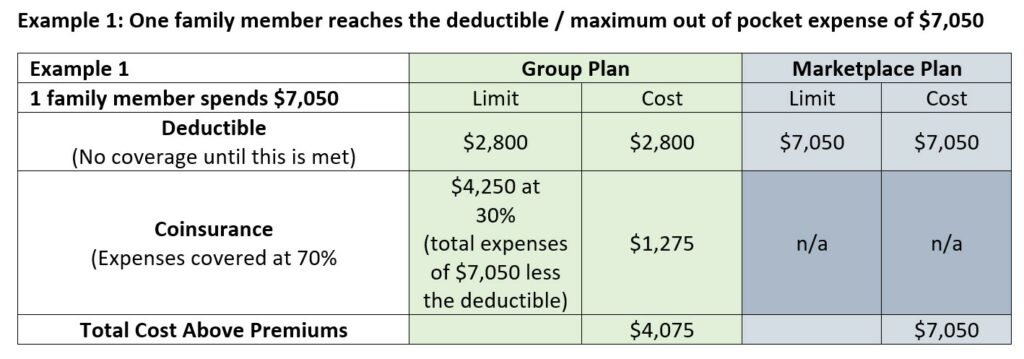

For the scenario where one family member meets the deductible, the additional cost in the Marketplace plan is $2,975 ($7,050 vs. $4,075). This doesn’t come close to offsetting the $13,660 in premium savings.

Any expenses above this amount for this family member would be fully covered in the Marketplace plan, while still in the 70% coverage zone for the group plan until that out-of-pocket limit is met. So, the difference in benefit between the two plans is never more than $2,975 for an individual.

What if two family members meet the deductible? Well, then you have also met the family deductible. Let’s look at that next.

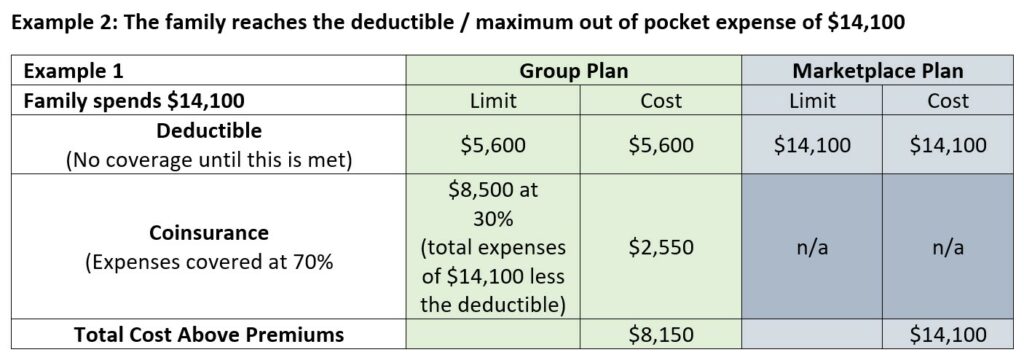

For the scenario where the family meets the deductible (either by one person meeting the whole amount or by the combination of all costs exceeding the limit), the additional cost in the Marketplace plan is $5,950 ($14,100 vs. $8,150). Again, this doesn’t come close to offsetting the $13,660 in premium savings—we are still better off by $7,710.

Any expenses above this amount for the whole family would be fully covered in the Marketplace plan, while still in the 70% coverage zone for the group plan until that out-of-pocket limit is met. So the difference in benefit between the two plans is never more than $5,950 for a family.

Our actual experience with coverage and usage:

Health care usage can be unpredictable. We all hope to not need any medical attention, but we want to be adequately prepared for a situation when we would need a lot of it. I was curious how much benefit we have actually received from our insurance coverage since we joined the plan in 2021. The insurance company’s website allows me to export all our claims history to a spreadsheet, so I didn’t have to wonder long. In the spreadsheet, I can sort by family member or by date and satisfy all my nerdy curiosity.

In 2020, we had two broken bones (ahem, the same person both times, about two months apart), one emergency room visit (unrelated to broken bones), and some drive-through COVID tests back in the early days of the pandemic when we didn’t have at-home tests or vaccines.

The total amount billed to the insurance company for our family’s care in 2020 was $26,904, of which $7,273 was our responsibility (after discounts and what the plan paid for preventive care). If we had been with the group plan, assuming roughly the same discounts and preventive care coverage, we would have met the family deducible that year and would have paid about $1,170 less out of our own pockets for those costs. On the other hand, in 2020 we saved $11,371 on premiums, so we still ended up saving $10,201 with our Marketplace plan.

So far in 2021, we have been healthier (knock on wood). The total amount billed to the insurance company for our care so far this year is $8,087, of which $1,533 is our responsibility (after discounts and what the plan paid for preventive care). If we were on the group plan, we would not have met the deductible yet, so there is nothing to offset the $11,311 we are saving on premiums this year.

Some common misconceptions

When I tell people that we are using a Marketplace plan for our health coverage, I often get some of the same objections. There are some misconceptions that are prevalent surrounding this health insurance option. I will address just a couple of them here:

- Yes, you can use the exchange even if you are eligible for health insurance through your job. You are just less likely to receive a subsidy or a tax credit. You do have to indicate on your application whether you are eligible for healthcare through your job but answering “yes” does not disqualify you from using the plan. This information, along with information about your income and your household size, will help determine how much you will pay for your Marketplace plan. We do not qualify for any subsidy or tax credits, so all the numbers in this article relate to a full-price plan on the Marketplace.

- Yes, your premiums are still tax-deductible. Instead of being paid pre-tax from your paycheck, you report the total premiums paid as a deduction on your tax return. Just like a deduction for an HSA contribution, this is an “above the line” deduction, meaning that it is before your Adjusted Gross Income is calculated. You can deduct these premiums and still use the standard deduction “below the line.”

I feel grateful and relieved that our switch two years ago has worked out so well up to this point. I encourage you to consider all your options at open enrollment time, and enlist the help of a numbers person if you have a hard time figuring out which option might be the best fit for you.