We are nine weeks into a correction that began in mid-September. Since that time, major stock indexes have lost all the year’s gains and then some. Fixed income markets have also declined.

We know that markets go up and down. When they go down, it really helps when your adviser can illustrate how your portfolio would have performed in past market cycles.

At Together Planning, we use software to illustrate how our clients’ portfolios would have likely performed in the past. One of these tools is called Scenarios, and it is from one of our software providers, Riskalyze. This tool can help clients feel more confident in their investments and bring the long view into focus.

As an example, let me show you how we use Scenarios from Riskalyze to illustrate returns over different periods of time. The following illustrations are for our Total Return Qualified model, which has moderate risk. I’ve compared a hypothetical investment of $500,000 into this model, to a hypothetical investment of the same amount into the US Stock Market, which has considerably more risk.

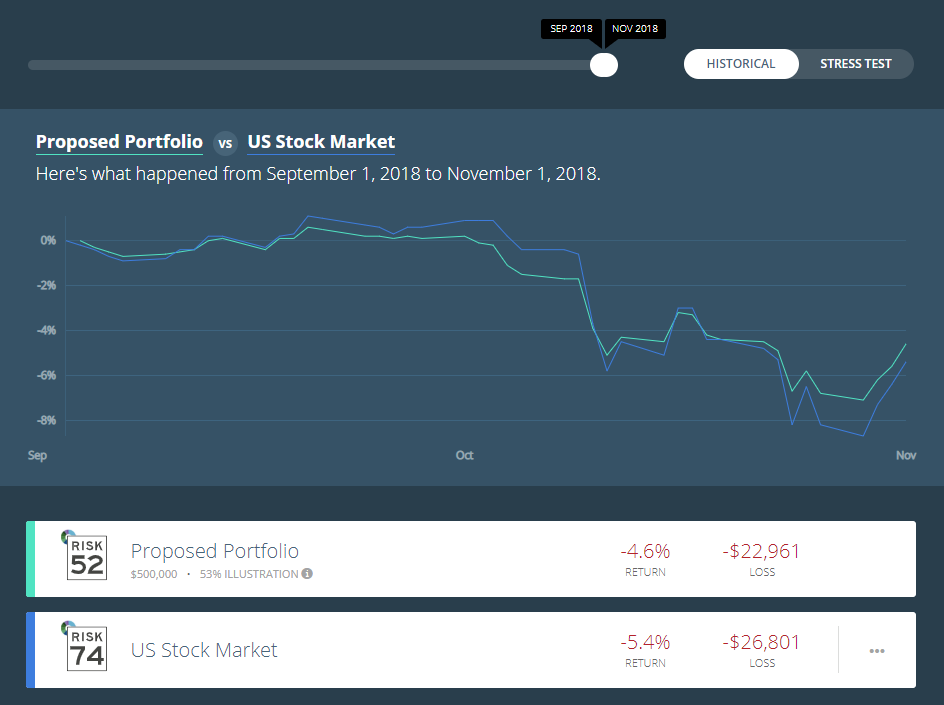

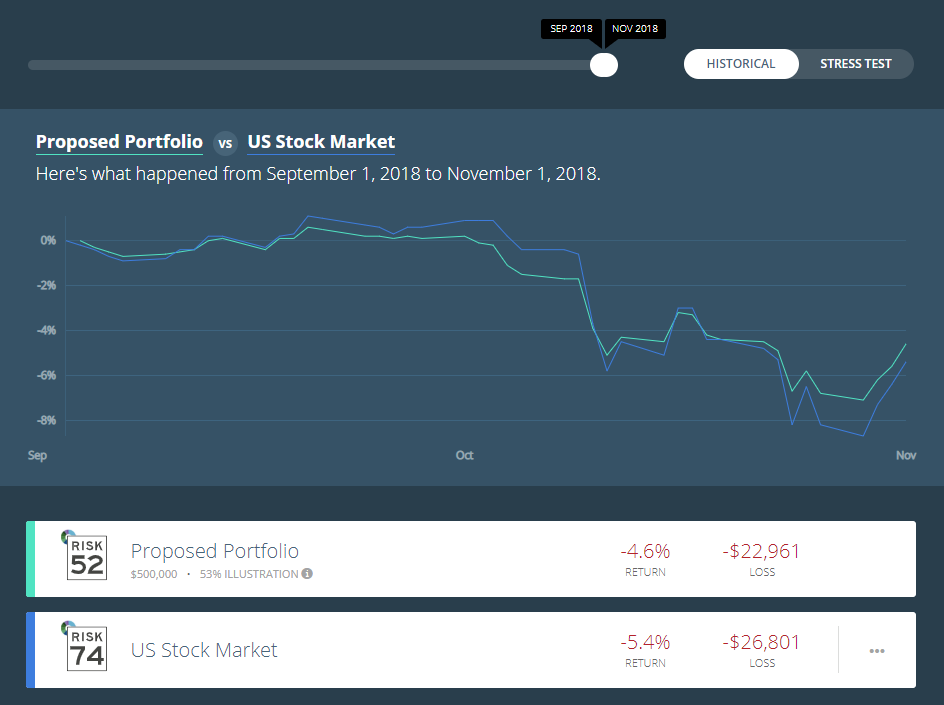

Here is a view of the comparison over the last two months:

The line in green is our model, and the line in blue is the US Stock Market. Our model was -4.6% over that time period, compared to -5.4% for the US Stock Market. The model is more conservative and more diversified than the US Stock Market. It contains fixed income holdings in addition to stocks. This diversification explains why the model did not decline as much as the US Stock Market.

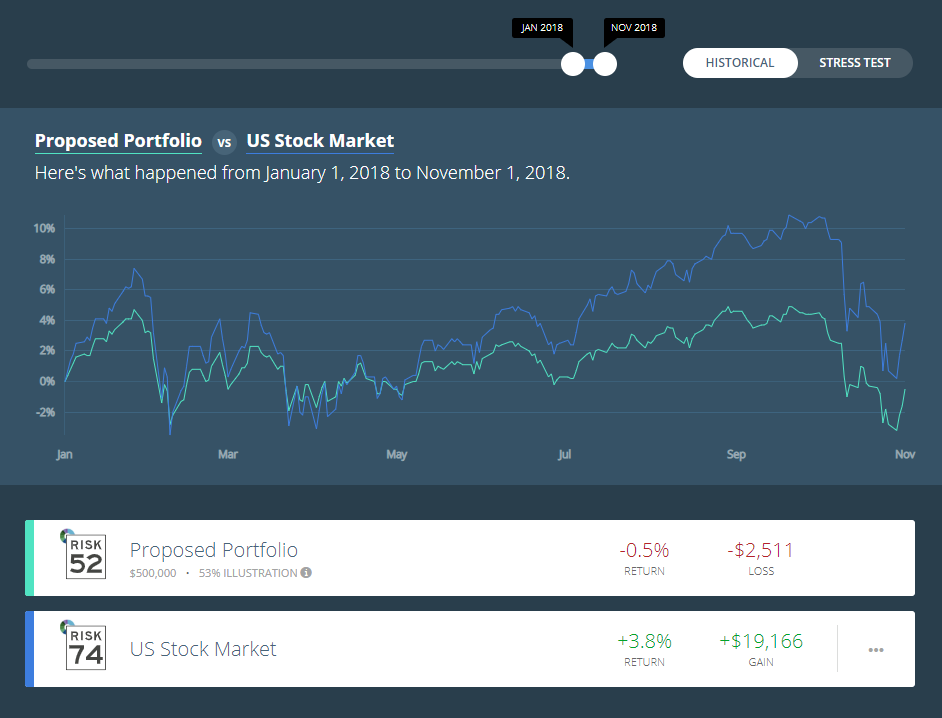

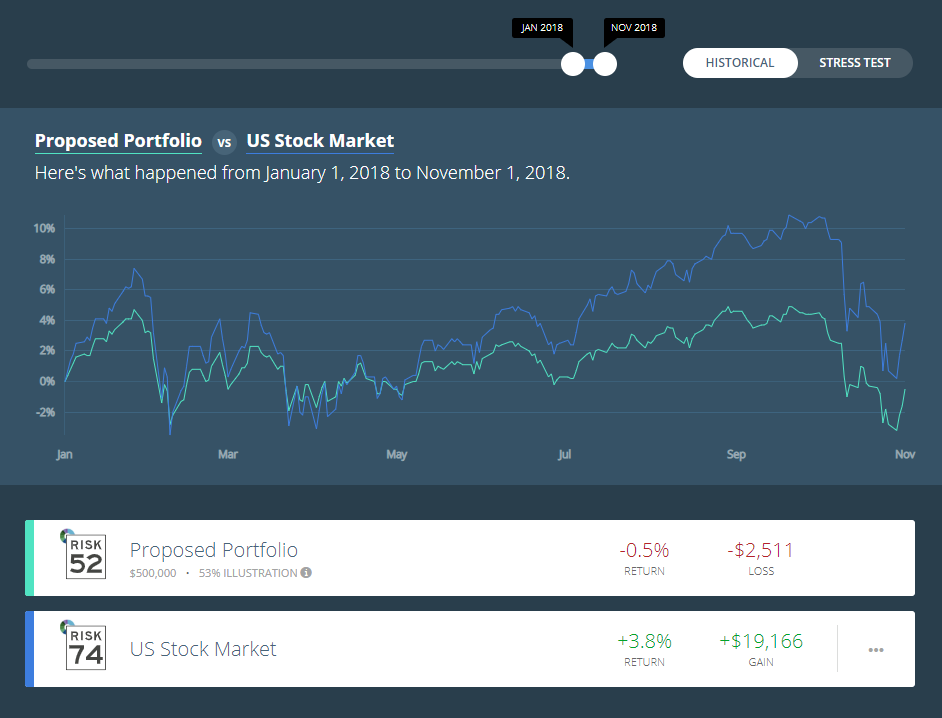

Here is the same comparison but year-to-date:

The line in green is our model, and the line in blue is the US Stock Market. Our model was -4.6% over that time period, compared to -5.4% for the US Stock Market. The model is more conservative and more diversified than the US Stock Market. It contains fixed income holdings in addition to stocks. This diversification explains why the model did not decline as much as the US Stock Market.

Here is the same comparison but year-to-date:

Year-to-date, the model underperformed the US Stock Market. This is because the model has a lower risk number (52 verses 74). Its lower risk will often cause it to underperform stocks during growth periods, such as between January and September of this year.

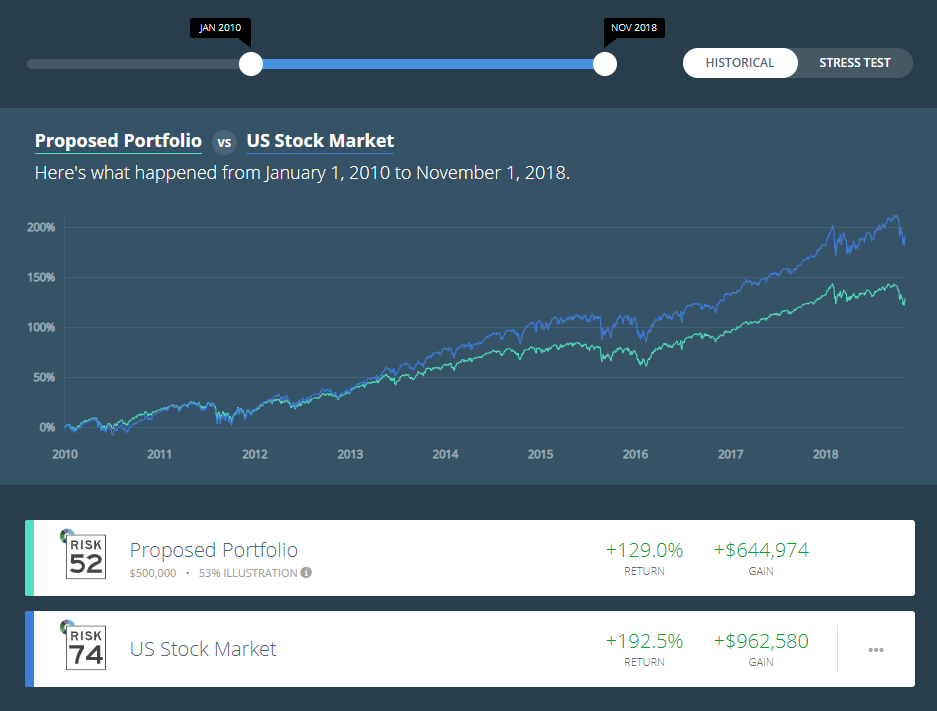

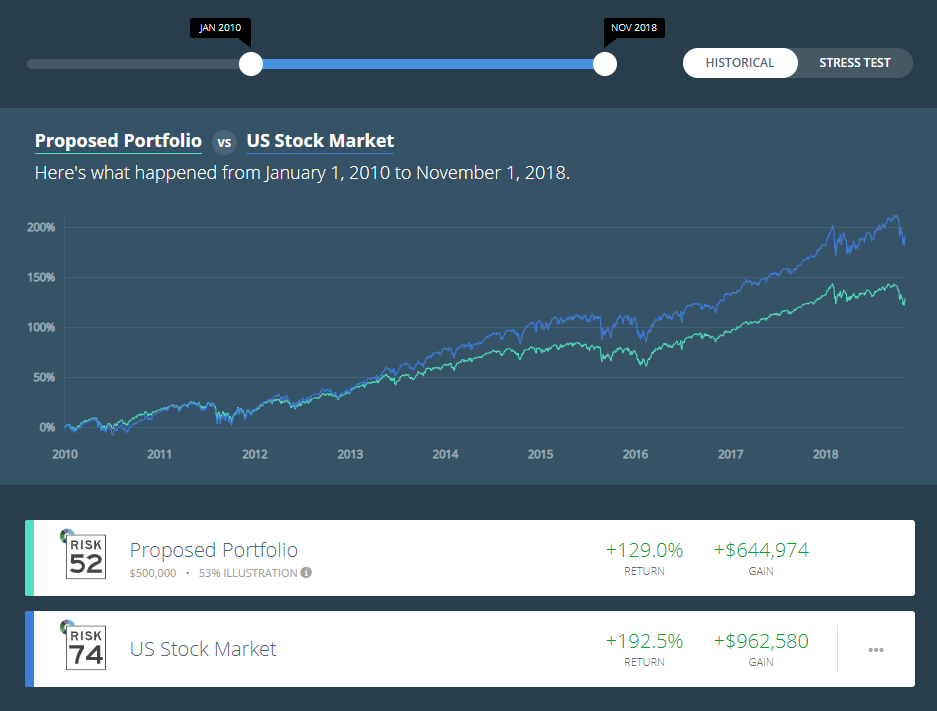

Now, let’s look at this comparison since January of 2010:

Year-to-date, the model underperformed the US Stock Market. This is because the model has a lower risk number (52 verses 74). Its lower risk will often cause it to underperform stocks during growth periods, such as between January and September of this year.

Now, let’s look at this comparison since January of 2010:

Since 2010, the US Stock Market underwent a long period of growth. It significantly outperformed the model. So, are you thinking that investing in an all-US Stock Market portfolio is the way to go?

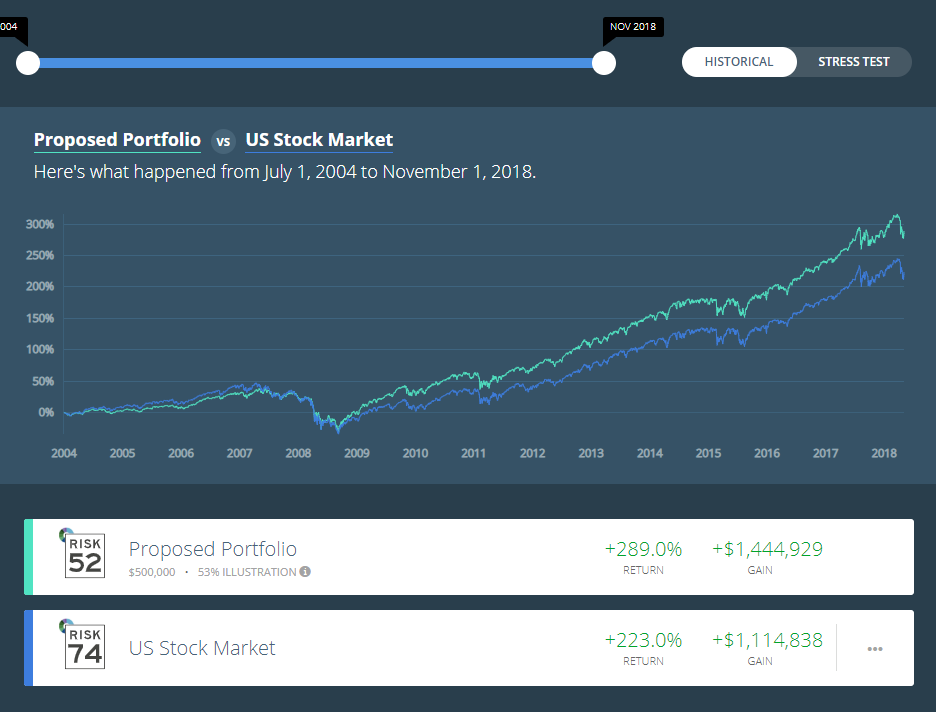

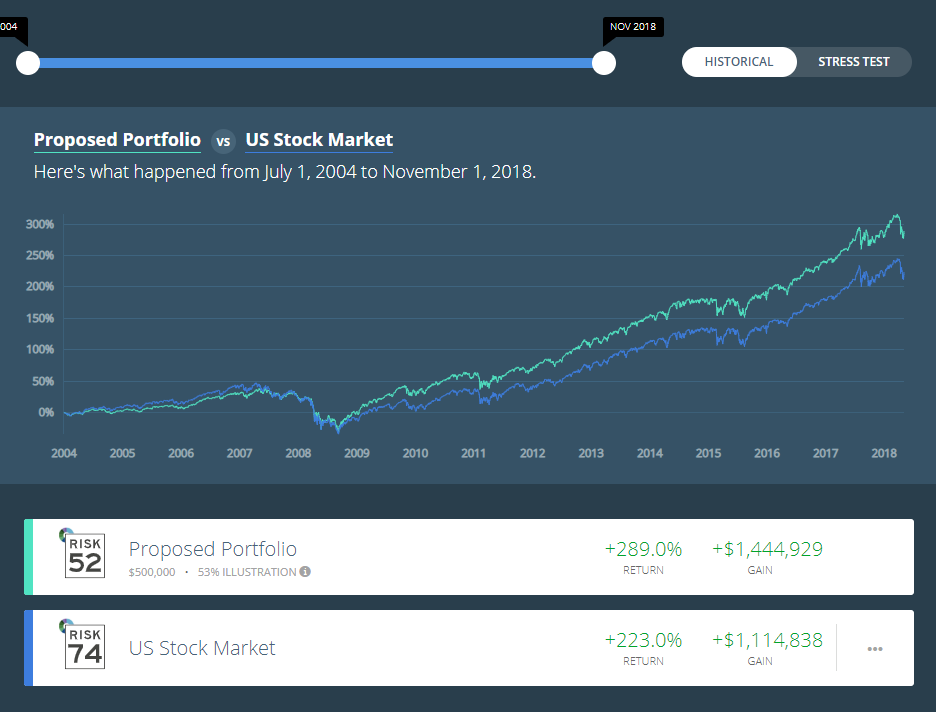

Here’s a look at how our model performed compared to the US Stock Market since July of 2004, which is a far back as Scenarios will go:

Since 2010, the US Stock Market underwent a long period of growth. It significantly outperformed the model. So, are you thinking that investing in an all-US Stock Market portfolio is the way to go?

Here’s a look at how our model performed compared to the US Stock Market since July of 2004, which is a far back as Scenarios will go:

During this 14-year period, our model outperformed the US Stock Market, with considerably less risk.

Over the last two months, stock prices have declined, causing many people to question whether they are invested correctly. During these periods, it can be very helpful to work with an adviser who can put this market volatility into perspective for you, using technology.

And if you are really wanting to be on top of things, you should consider working with a fee-only financial planner that can match your goals to your investment plan.

We’d love to be your adviser. Visit our website at www.togetherplanning.com, and contact us to schedule a phone call.

Click here for information on how we invest.

Click here to discover your risk number.

Click here to learn about how we help you with financial planning.

We want you to worry less and enjoy more.

During this 14-year period, our model outperformed the US Stock Market, with considerably less risk.

Over the last two months, stock prices have declined, causing many people to question whether they are invested correctly. During these periods, it can be very helpful to work with an adviser who can put this market volatility into perspective for you, using technology.

And if you are really wanting to be on top of things, you should consider working with a fee-only financial planner that can match your goals to your investment plan.

We’d love to be your adviser. Visit our website at www.togetherplanning.com, and contact us to schedule a phone call.

Click here for information on how we invest.

Click here to discover your risk number.

Click here to learn about how we help you with financial planning.

We want you to worry less and enjoy more.

The line in green is our model, and the line in blue is the US Stock Market. Our model was -4.6% over that time period, compared to -5.4% for the US Stock Market. The model is more conservative and more diversified than the US Stock Market. It contains fixed income holdings in addition to stocks. This diversification explains why the model did not decline as much as the US Stock Market.

Here is the same comparison but year-to-date:

The line in green is our model, and the line in blue is the US Stock Market. Our model was -4.6% over that time period, compared to -5.4% for the US Stock Market. The model is more conservative and more diversified than the US Stock Market. It contains fixed income holdings in addition to stocks. This diversification explains why the model did not decline as much as the US Stock Market.

Here is the same comparison but year-to-date:

Year-to-date, the model underperformed the US Stock Market. This is because the model has a lower risk number (52 verses 74). Its lower risk will often cause it to underperform stocks during growth periods, such as between January and September of this year.

Now, let’s look at this comparison since January of 2010:

Year-to-date, the model underperformed the US Stock Market. This is because the model has a lower risk number (52 verses 74). Its lower risk will often cause it to underperform stocks during growth periods, such as between January and September of this year.

Now, let’s look at this comparison since January of 2010:

Since 2010, the US Stock Market underwent a long period of growth. It significantly outperformed the model. So, are you thinking that investing in an all-US Stock Market portfolio is the way to go?

Here’s a look at how our model performed compared to the US Stock Market since July of 2004, which is a far back as Scenarios will go:

Since 2010, the US Stock Market underwent a long period of growth. It significantly outperformed the model. So, are you thinking that investing in an all-US Stock Market portfolio is the way to go?

Here’s a look at how our model performed compared to the US Stock Market since July of 2004, which is a far back as Scenarios will go:

During this 14-year period, our model outperformed the US Stock Market, with considerably less risk.

Over the last two months, stock prices have declined, causing many people to question whether they are invested correctly. During these periods, it can be very helpful to work with an adviser who can put this market volatility into perspective for you, using technology.

And if you are really wanting to be on top of things, you should consider working with a fee-only financial planner that can match your goals to your investment plan.

We’d love to be your adviser. Visit our website at www.togetherplanning.com, and contact us to schedule a phone call.

Click here for information on how we invest.

Click here to discover your risk number.

Click here to learn about how we help you with financial planning.

We want you to worry less and enjoy more.

During this 14-year period, our model outperformed the US Stock Market, with considerably less risk.

Over the last two months, stock prices have declined, causing many people to question whether they are invested correctly. During these periods, it can be very helpful to work with an adviser who can put this market volatility into perspective for you, using technology.

And if you are really wanting to be on top of things, you should consider working with a fee-only financial planner that can match your goals to your investment plan.

We’d love to be your adviser. Visit our website at www.togetherplanning.com, and contact us to schedule a phone call.

Click here for information on how we invest.

Click here to discover your risk number.

Click here to learn about how we help you with financial planning.

We want you to worry less and enjoy more.